Romania Taps Eurobond Market Again to Fund Budget Gap

NeutralFinancial Markets

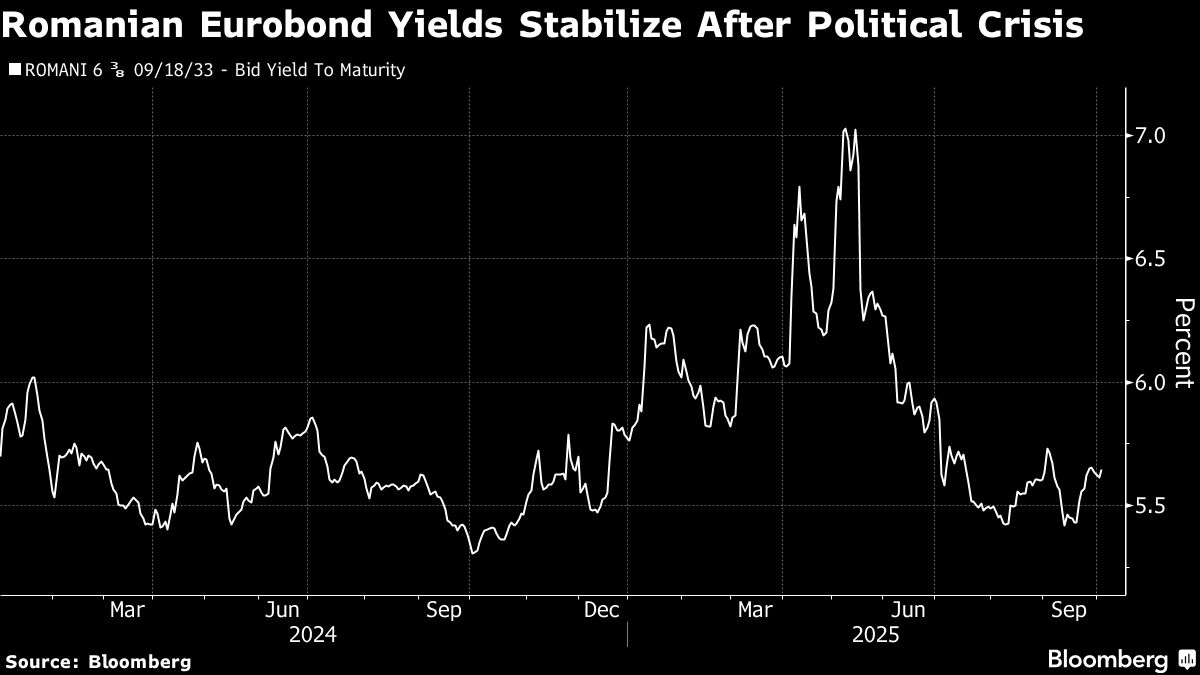

Romania has entered the Eurobond market for the fourth time this year, aiming to address a larger-than-anticipated budget deficit and initiate funding for 2026. This move is significant as it reflects the country's ongoing efforts to manage its fiscal challenges while planning for future financial needs.

— Curated by the World Pulse Now AI Editorial System