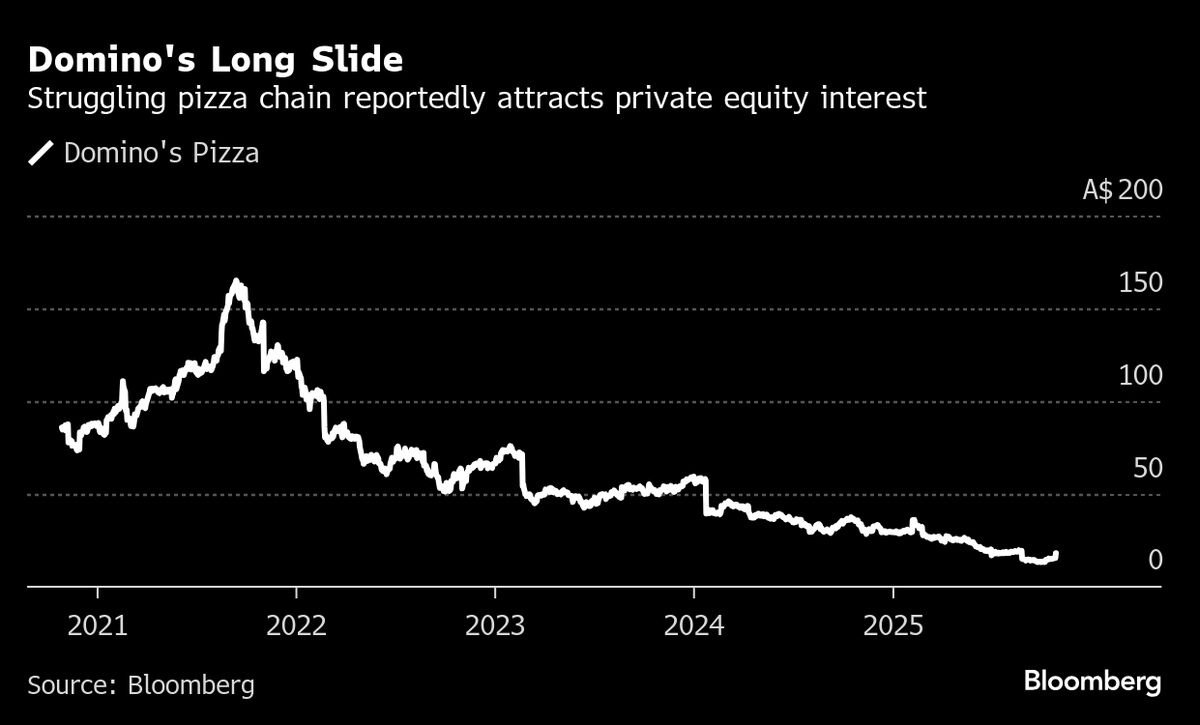

Domino’s Pizza Enterprises Soars on Report Bain Eyeing Takeover

PositiveFinancial Markets

Domino's Pizza Enterprises Ltd. is experiencing a significant surge in its stock prices following reports that Bain Capital is contemplating a takeover of the fast-food chain for up to A$4 billion. This potential acquisition is noteworthy as it highlights the growing interest in the food sector and could lead to strategic changes that enhance Domino's market position. Investors are optimistic about the implications of such a deal, which could bring new resources and innovation to the company.

— Curated by the World Pulse Now AI Editorial System