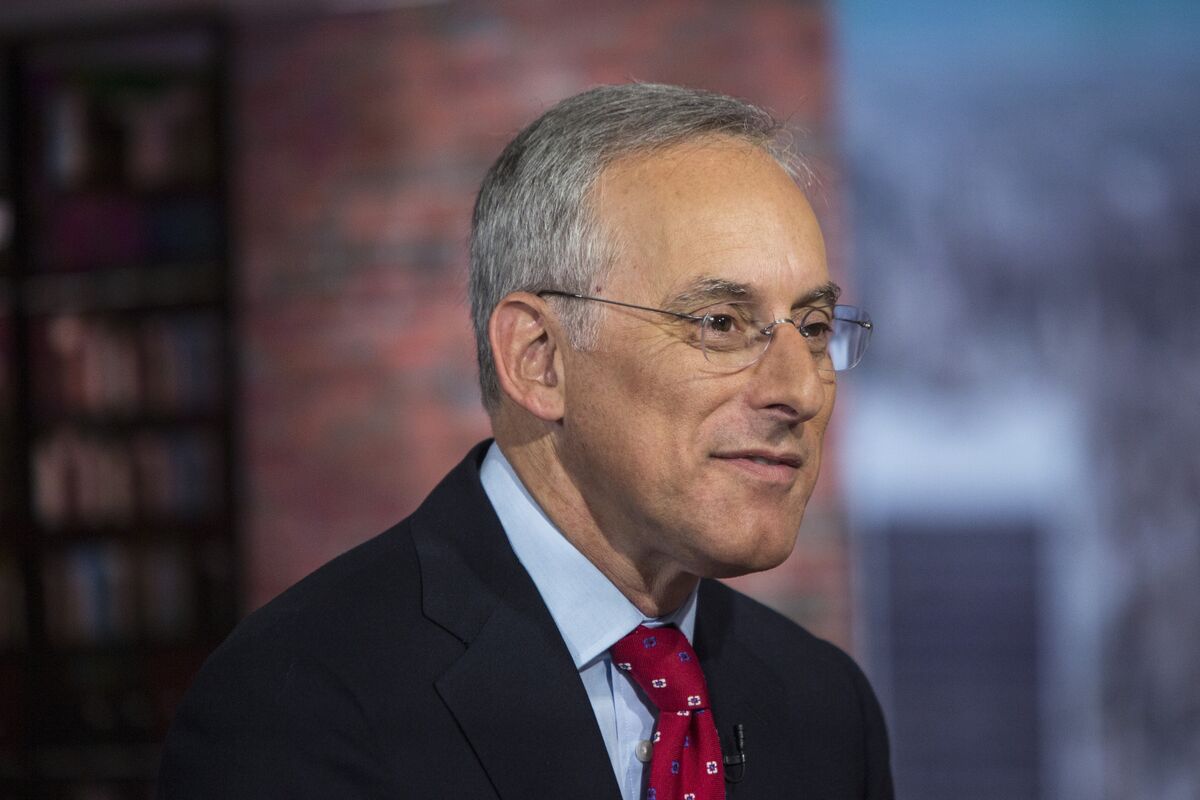

Top Goldman US Stock Strategist David Kostin to Retire This Year

NeutralFinancial Markets

David Kostin, the chief US equity strategist at Goldman Sachs, is retiring after over 30 years with the firm. His departure marks the end of an era for the investment bank, as Kostin has been a key figure in shaping its equity strategy. This transition could signal changes in Goldman Sachs' approach to the market, making it a noteworthy moment for investors and analysts alike.

— Curated by the World Pulse Now AI Editorial System