ECB Keeps Rates Unchanged for Third Meeting

NeutralFinancial Markets

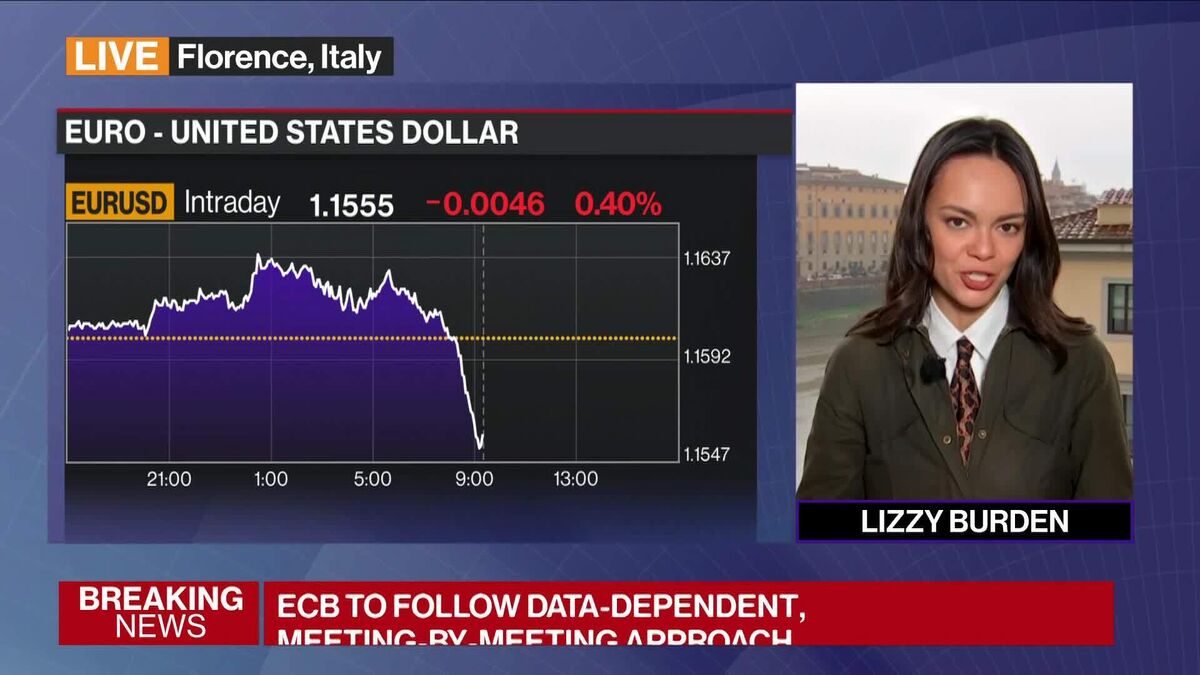

The European Central Bank has decided to keep interest rates unchanged for the third consecutive meeting, maintaining the deposit rate at 2%. This decision comes as inflation remains stable and the economy shows signs of growth. Analysts had anticipated this move, and the ECB has indicated that future decisions will be made based on incoming data, emphasizing a cautious approach. This is significant as it reflects the bank's strategy to navigate economic conditions carefully.

— Curated by the World Pulse Now AI Editorial System