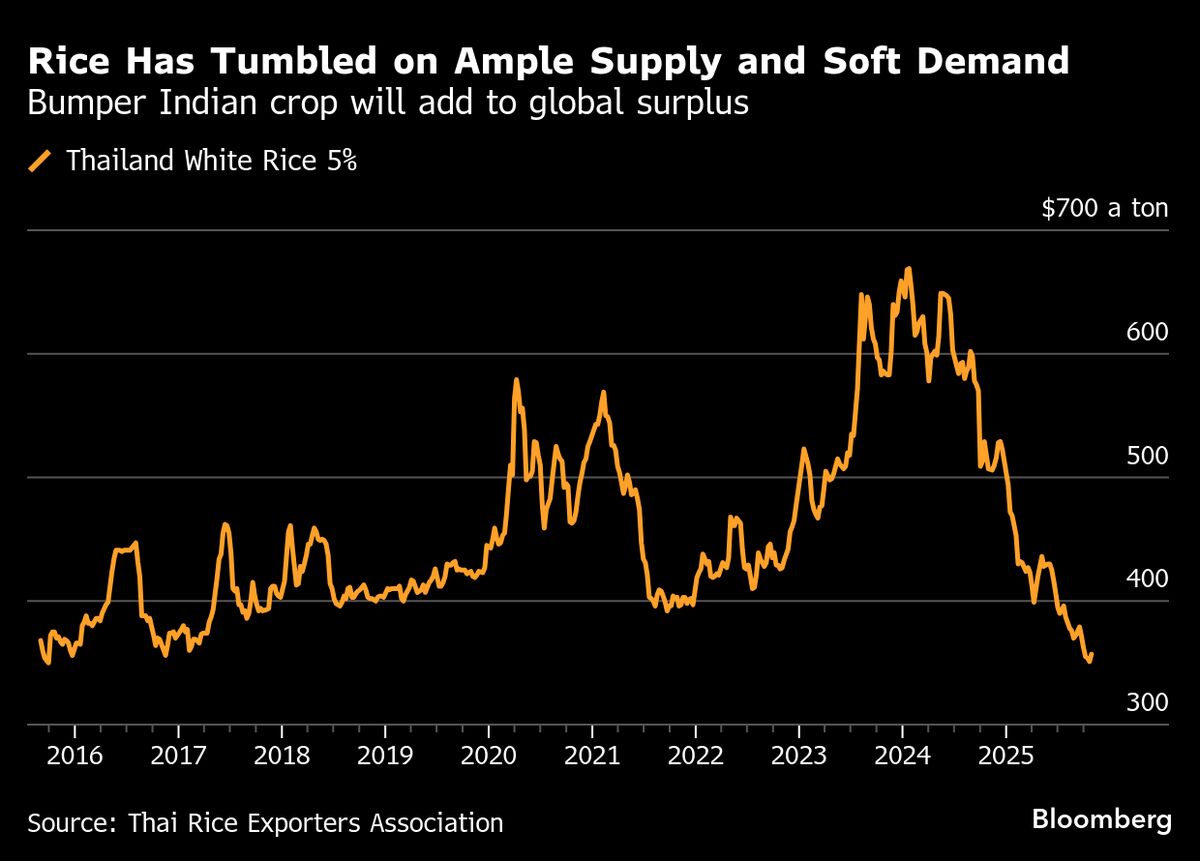

Rice Prices in Asia Face More Pressure from Bumper Indian Crop

NegativeFinancial Markets

Rice Prices in Asia Face More Pressure from Bumper Indian Crop

Rice prices in Asia are expected to decline further due to a bumper harvest in India, which is contributing to an already abundant global supply. This situation is significant as it affects not only the market dynamics but also the livelihoods of local farmers, especially in countries that rely heavily on rice imports. The world's largest importer is reducing its overseas purchases to protect its domestic agricultural sector, highlighting the delicate balance between global trade and local economic stability.

— via World Pulse Now AI Editorial System