Rogers Mulls IPO Versus Private Capital as It Builds a Sports Empire

NeutralFinancial Markets

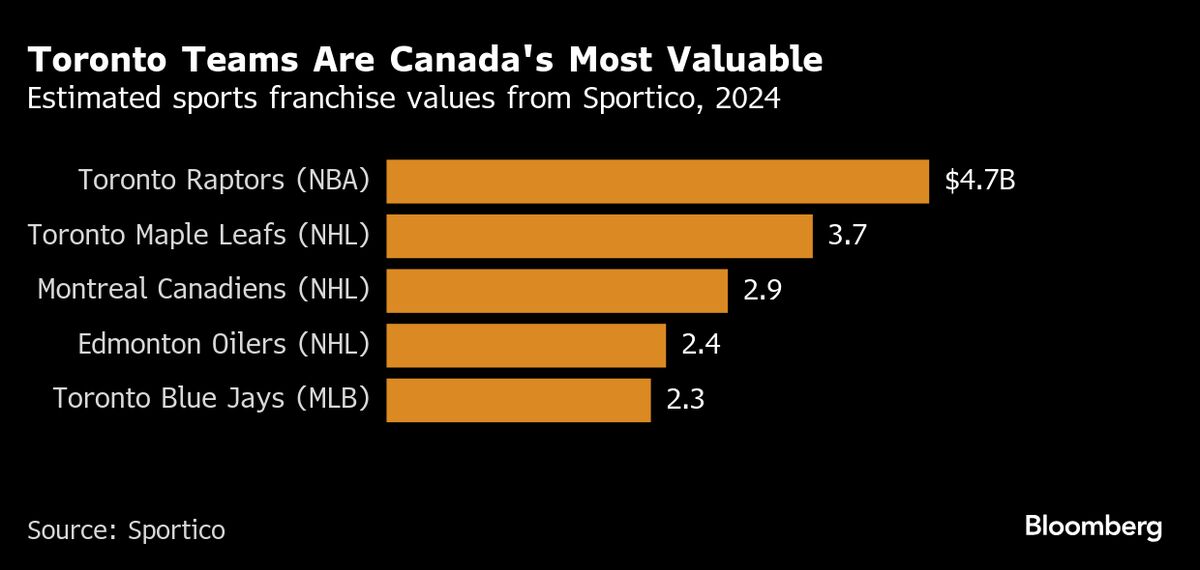

Rogers Communications Inc. is currently weighing its options between pursuing an initial public offering (IPO) or attracting private capital for its sports and entertainment division. This decision comes as the company experiences significant interest from private investors, highlighting the potential value of its sports assets. The outcome of this deliberation could shape the future of Rogers' sports empire and impact the broader Canadian sports landscape.

— Curated by the World Pulse Now AI Editorial System