Chinese Exports Unexpectedly Fall for First Time Since February

NegativeFinancial Markets

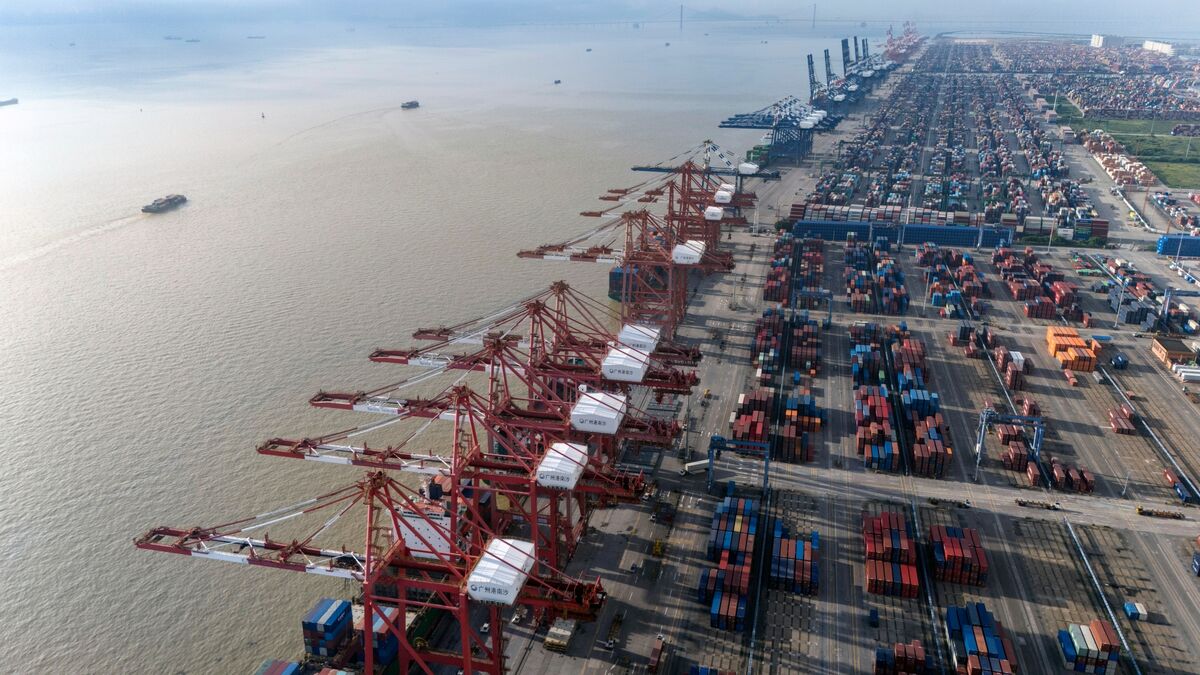

Chinese Exports Unexpectedly Fall for First Time Since February

China's exports have unexpectedly fallen for the first time since February, raising concerns about the country's economic stability amid renewed tensions with the US. This decline could signal a deeper slowdown as the year comes to a close, impacting global trade and economic forecasts.

— via World Pulse Now AI Editorial System