JPMorgan sees upside for EM, Eurozone stocks amid improving growth outlook

PositiveFinancial Markets

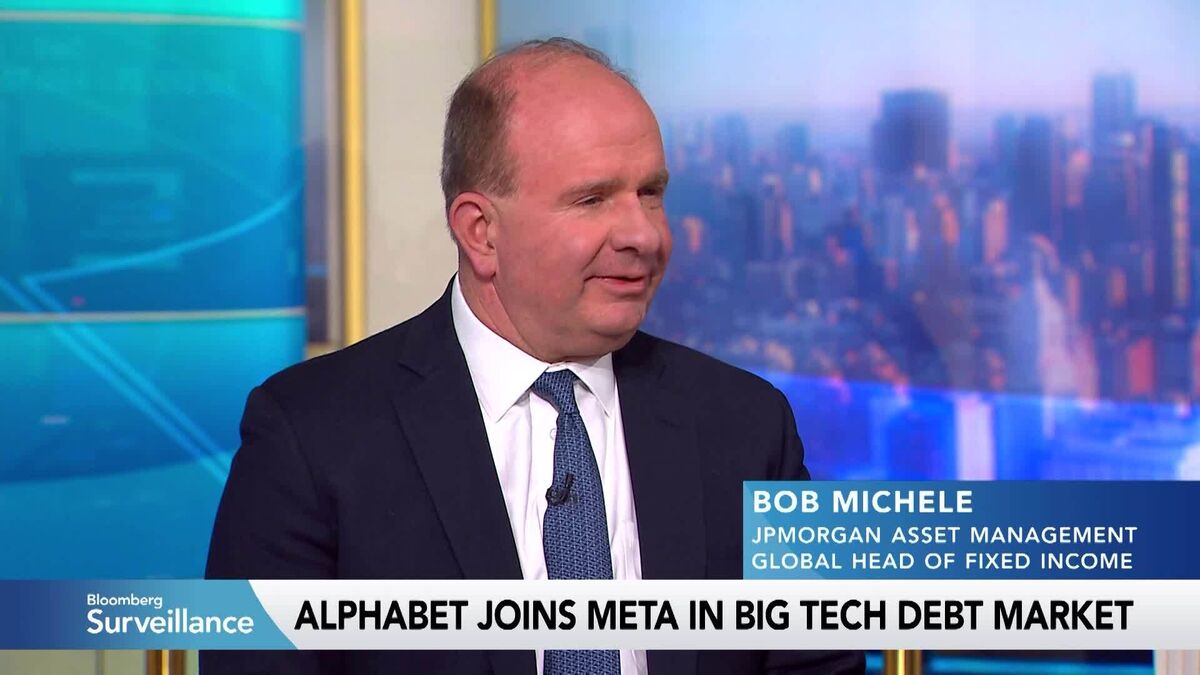

JPMorgan has expressed optimism about the potential for emerging markets and Eurozone stocks, citing an improving growth outlook. This is significant as it suggests that investors may find new opportunities in these regions, which could lead to increased investment and economic recovery. As global markets react to changing economic conditions, this positive sentiment from a major financial institution could influence market trends and investor confidence.

— Curated by the World Pulse Now AI Editorial System