Turkey’s Vestel in Talks to Swap Lira Loans Into Hard Currency

NeutralFinancial Markets

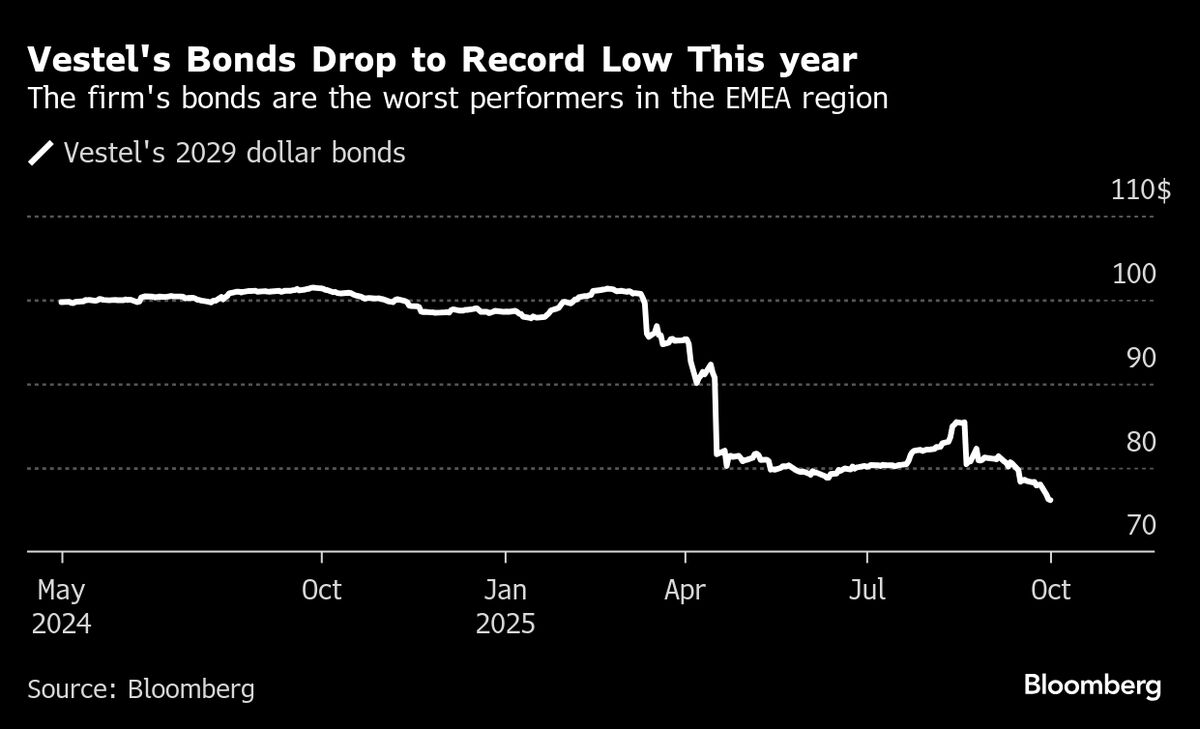

Turkey's Vestel Elektronik is currently negotiating with lenders to convert some of its lira loans into hard currency. This move comes as the home-appliance manufacturer faces challenges due to high interest rates and significant debt levels. The outcome of these discussions could have important implications for Vestel's financial stability and operational capacity in a volatile economic environment.

— Curated by the World Pulse Now AI Editorial System