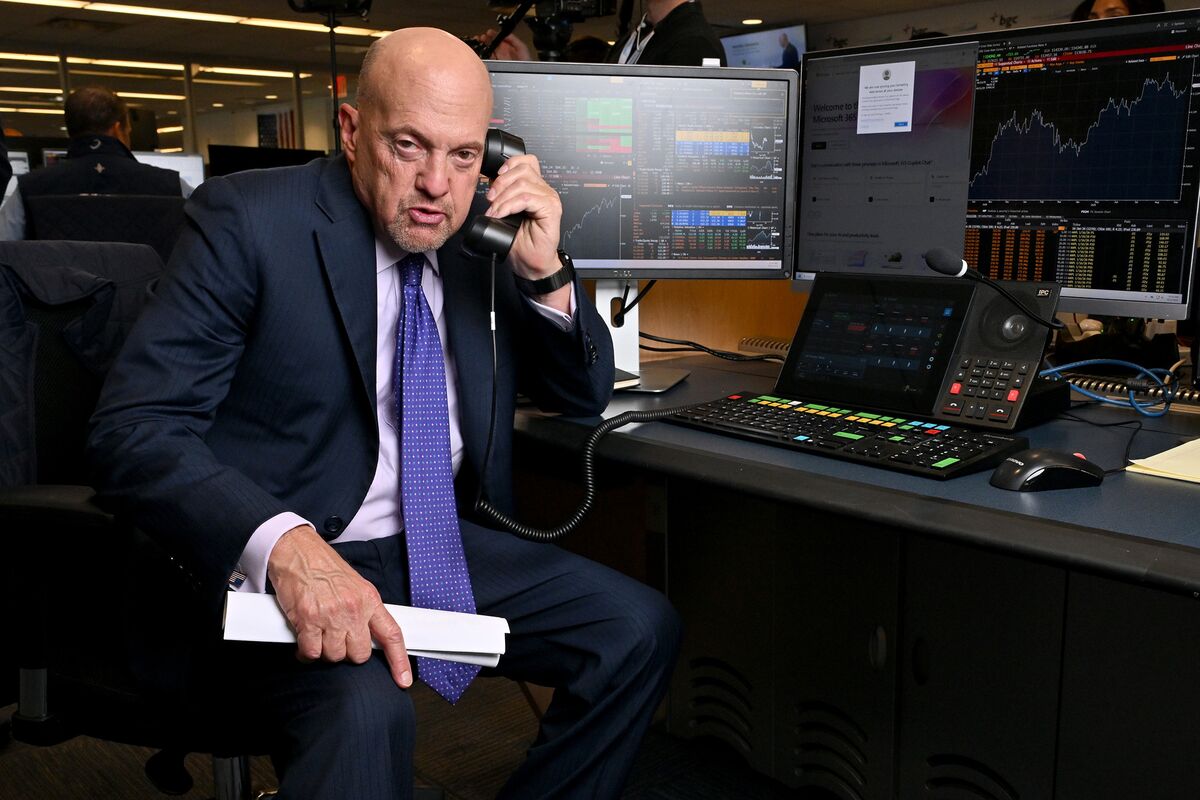

Futures tick lower; Micron among tech earnings this week - what’s moving markets

NeutralFinancial Markets

Futures are showing a slight decline as investors brace for a week filled with significant tech earnings, including reports from Micron. This week is crucial for market sentiment, as the performance of these tech giants could influence investor confidence and market trends moving forward.

— Curated by the World Pulse Now AI Editorial System