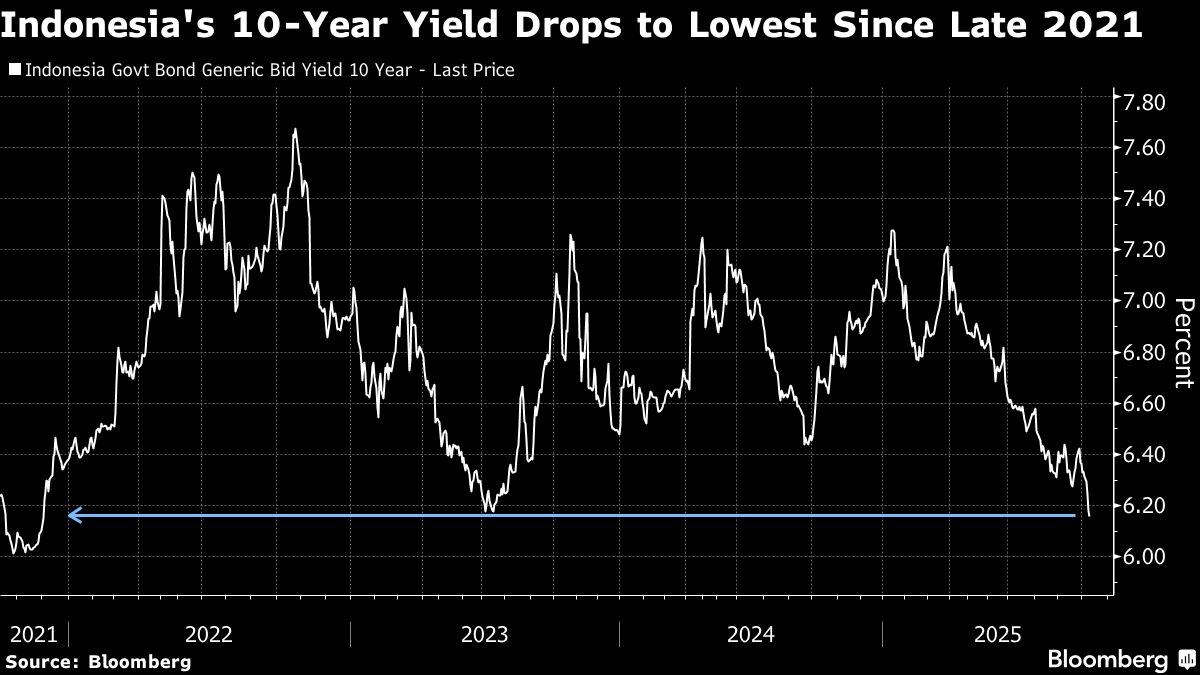

Indonesia’s 10-Year Bond Yield Falls to Lowest in Almost 4 Years

PositiveFinancial Markets

Indonesia's 10-year bond yield has fallen to its lowest point in almost four years, signaling a positive shift in the bond market. This decline is largely attributed to expectations of further interest-rate cuts, which have fueled a rally in government bonds. The strong demand from domestic investors highlights confidence in the country's economic outlook, making this development significant for both investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System