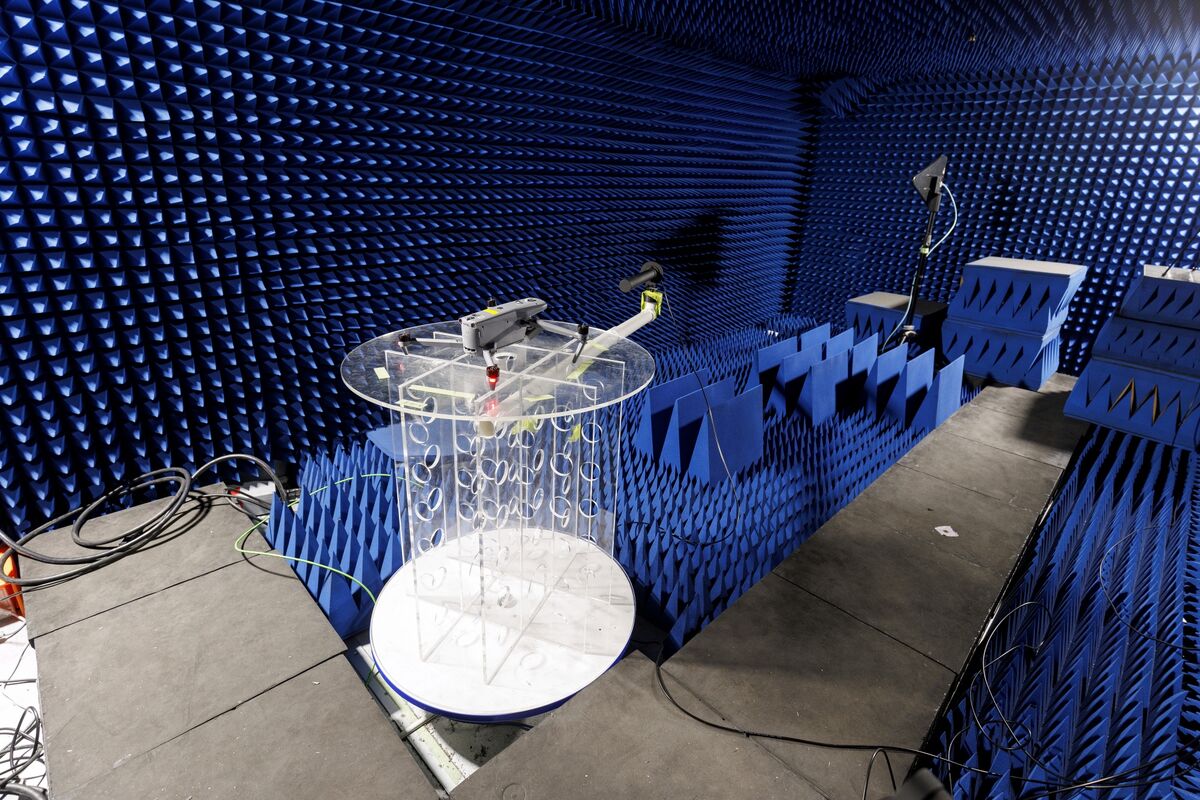

DroneShield to Change Incentive Plan After Executive Share Sales

NegativeFinancial Markets

- DroneShield Ltd. announced plans to modify its options incentive framework and will conduct an independent review of its disclosure and securities trading policies following a series of rapid share sales by its top executives, which have upset investors.

- This development is significant as it reflects the company's response to investor concerns regarding transparency and governance, potentially impacting investor confidence and the company's market reputation moving forward.

— via World Pulse Now AI Editorial System