Dollar Falls Amid Risk of Government Shutdown

NegativeFinancial Markets

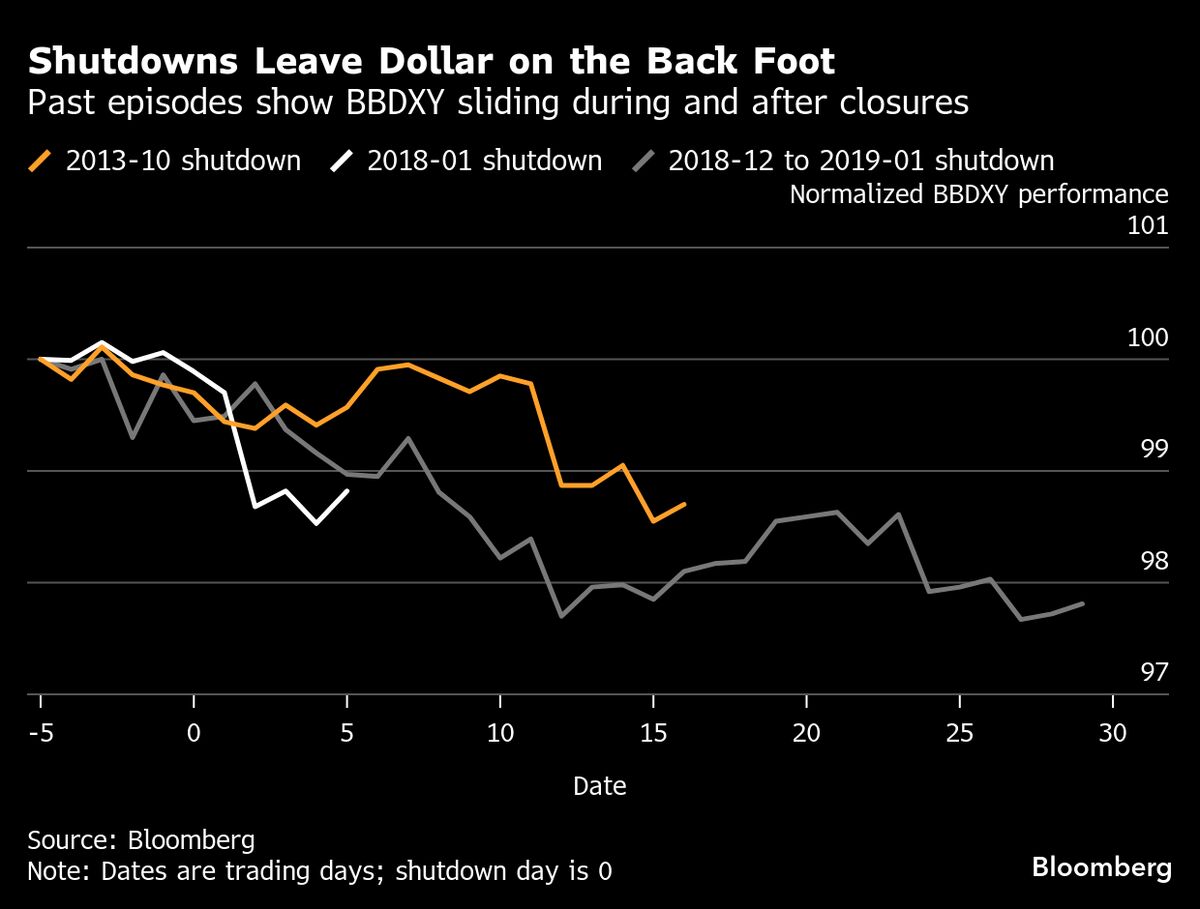

The dollar has dipped as concerns grow over a potential U.S. government shutdown, with both Democrats and Republicans racing against the clock to finalize a federal spending bill by midnight Tuesday. This situation is significant as a shutdown could disrupt government services and impact the economy, leading to uncertainty in financial markets.

— Curated by the World Pulse Now AI Editorial System