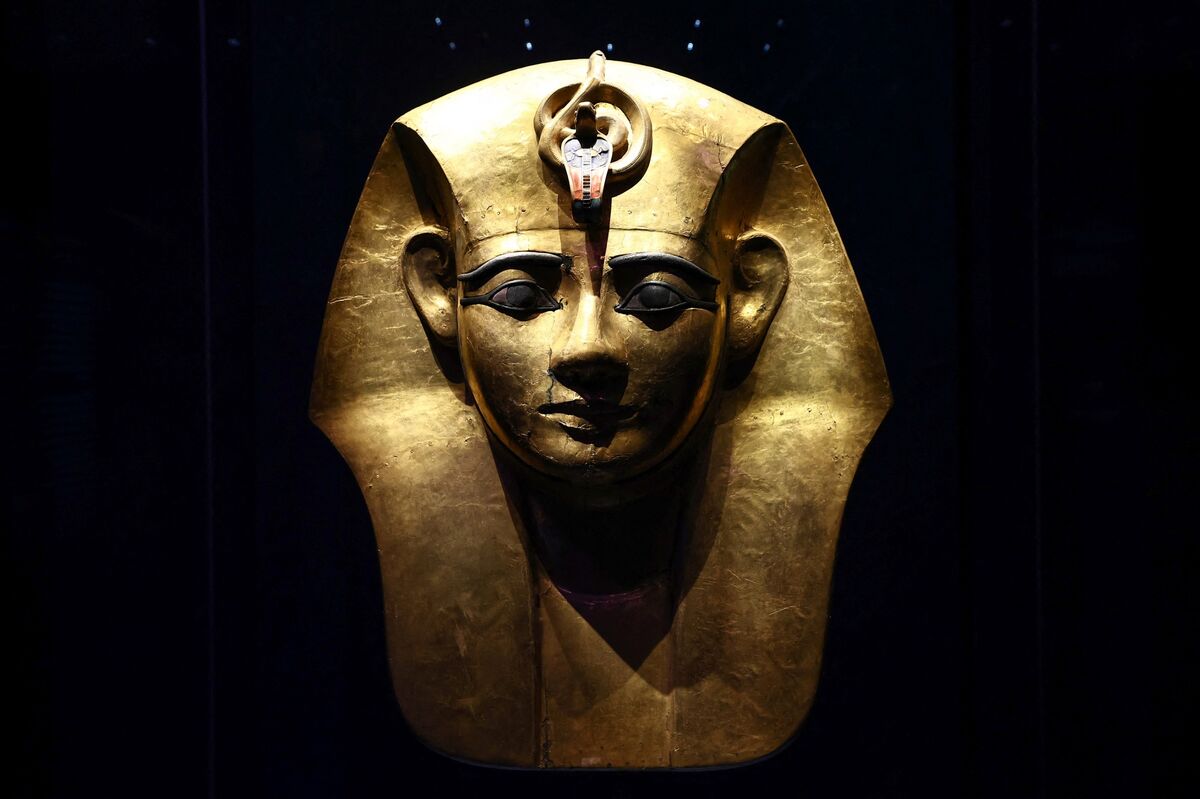

Egypt Says Stolen Pharaoh Bracelet Melted Down After $4,000 Sale

NegativeFinancial Markets

In a troubling incident, Egypt has reported the theft of a priceless golden bracelet from a Cairo museum, which was sold for around $4,000 and subsequently melted down. This theft not only highlights the ongoing issues of cultural heritage protection but also raises concerns about the security measures in place at museums. The arrest of four suspects is a step towards justice, but it underscores the need for stronger safeguards to prevent such losses in the future.

— Curated by the World Pulse Now AI Editorial System