Swift to Build a Blockchain-Based Ledger for Financial Firms

PositiveFinancial Markets

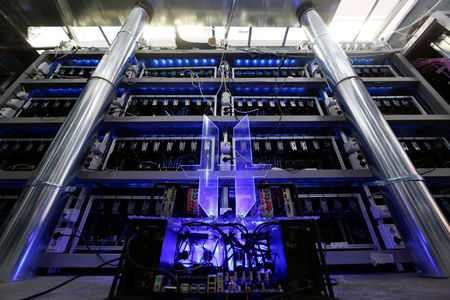

Swift is set to enhance its messaging system by integrating a blockchain-based ledger, a move that could revolutionize how financial institutions manage transactions. This upgrade is significant as it promises to improve transparency and efficiency in the financial sector, potentially transforming the way billions of dollars are transferred daily.

— Curated by the World Pulse Now AI Editorial System