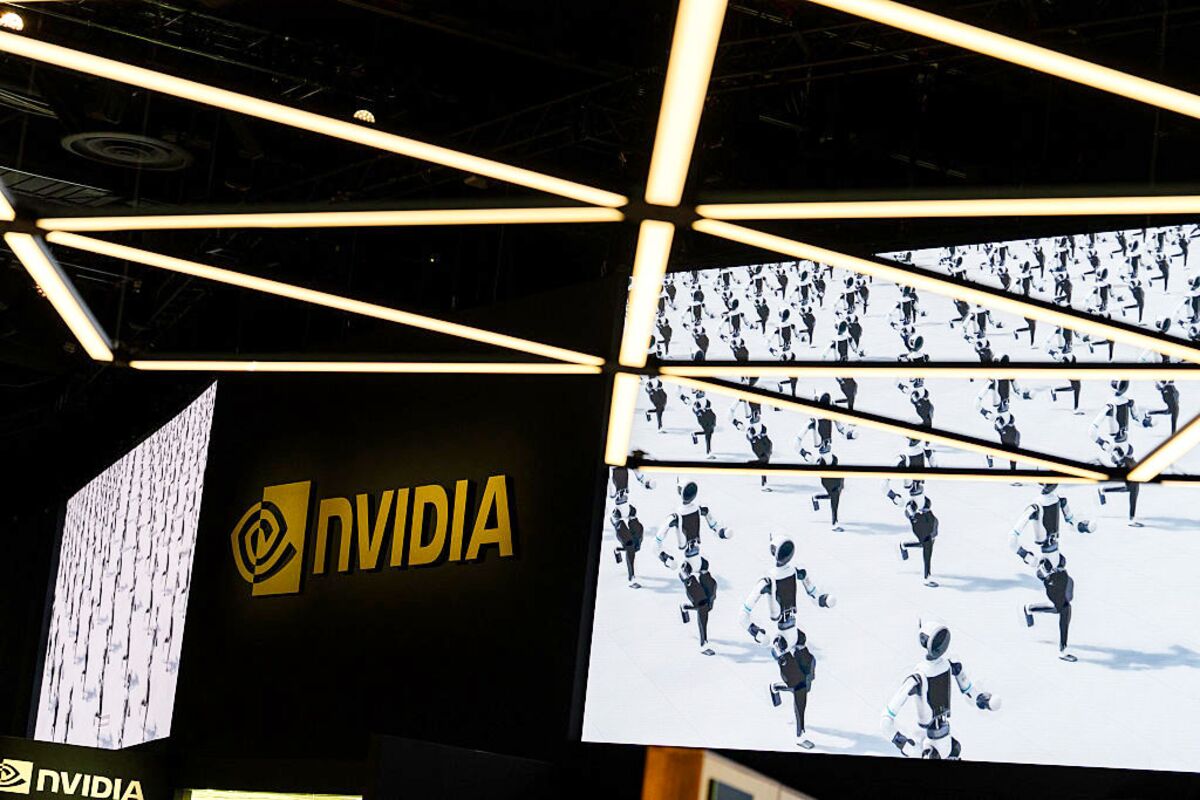

Nvidia Didn’t Save the Market. What’s Next for the AI Trade?

NegativeFinancial Markets

- Nvidia Corp.'s recent earnings report, which exceeded Wall Street's expectations, failed to alleviate investor concerns about a potential bubble in artificial intelligence stocks, leading to a continued decline in market confidence. Despite reporting record earnings, the anticipated calming effect on the market did not materialize.

- The inability of Nvidia's strong financial performance to stabilize investor sentiment raises questions about the sustainability of the AI sector's growth and the overall health of technology stocks. Investors remain wary, reflecting broader anxieties about market valuations.

- This situation highlights a recurring theme in the tech industry, where strong earnings can be overshadowed by fears of overvaluation and market corrections. The volatility in AI-related stocks suggests a complex interplay between investor expectations and economic realities, as concerns about a bubble persist even amid positive financial results.

— via World Pulse Now AI Editorial System