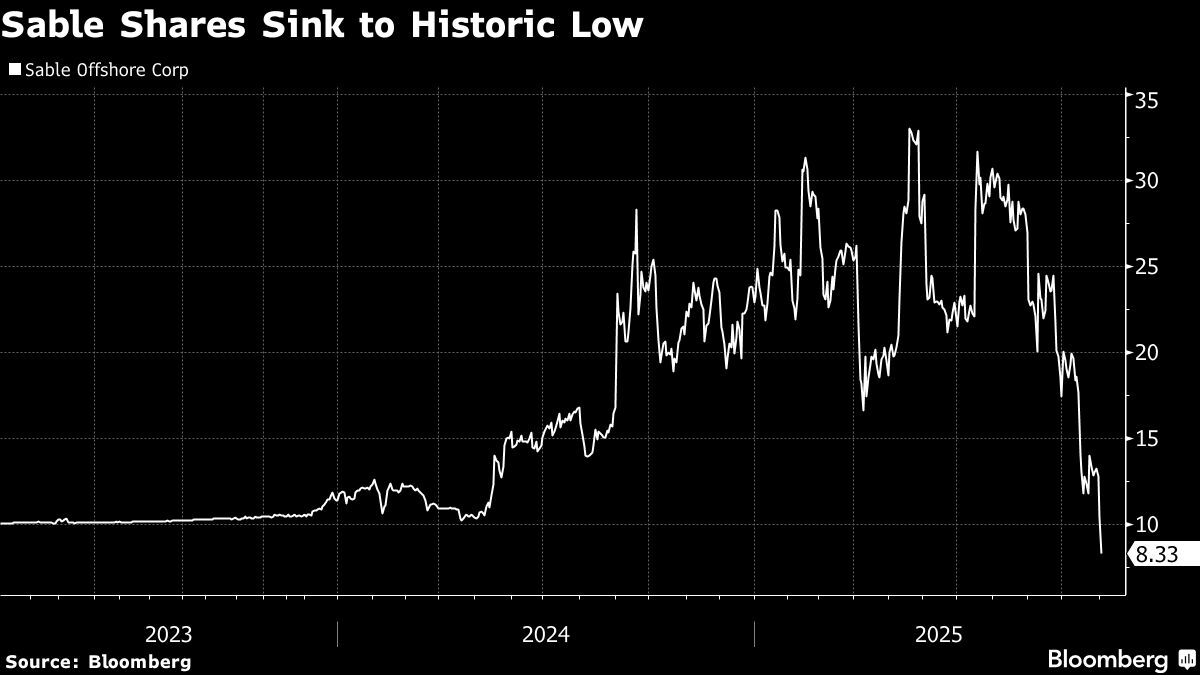

Sable Offshore stock tumbles to all-time low on funding plan

NegativeFinancial Markets

Sable Offshore's stock has plummeted to an all-time low following the announcement of a new funding plan. This significant drop raises concerns among investors about the company's financial stability and future prospects. The funding plan, while necessary for operations, has not been well received, leading to a lack of confidence in the stock. This situation is crucial as it reflects broader market trends and investor sentiment, which can impact the company's ability to raise capital and grow.

— Curated by the World Pulse Now AI Editorial System