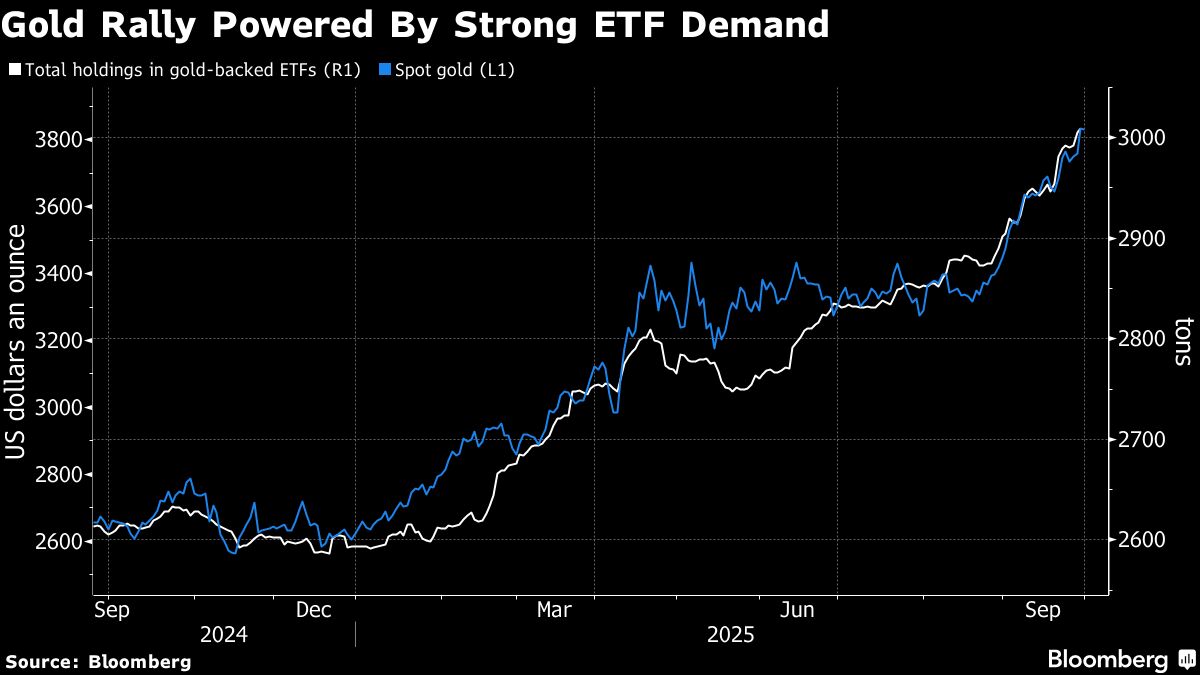

Gold Hits Fresh Record Above $3,800 on US Shutdown Jitters

PositiveFinancial Markets

Gold prices have surged to a new record above $3,800, driven by concerns over a potential US government shutdown. This increase reflects investor anxiety about the Federal Reserve's upcoming interest-rate decision, highlighting gold's role as a safe haven during economic uncertainty. As the situation develops, many are watching closely to see how these factors will influence market dynamics.

— Curated by the World Pulse Now AI Editorial System