U.S. government shutdown, Nike’s results, gold record - what’s moving markets

NeutralFinancial Markets

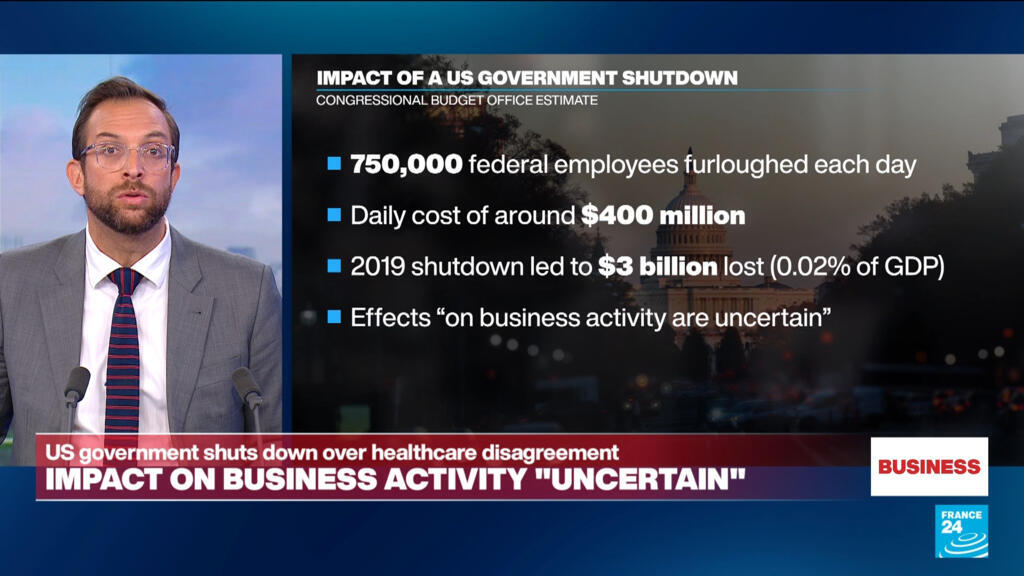

The recent U.S. government shutdown has raised concerns about its impact on the economy, while Nike's latest financial results have shown resilience amidst market fluctuations. Additionally, gold prices are reaching new records, reflecting investor sentiment in uncertain times. These developments are crucial as they influence market dynamics and investor decisions.

— Curated by the World Pulse Now AI Editorial System