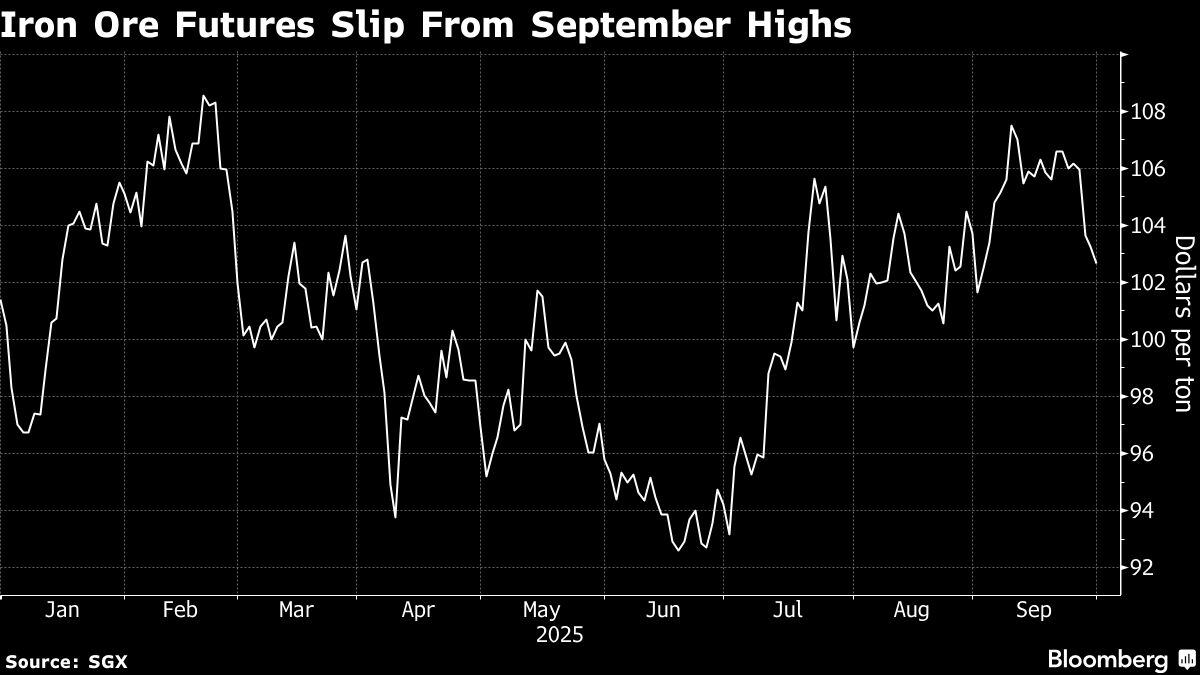

China manufacturing PMI shrinks for sixth consecutive month in September

NegativeFinancial Markets

In September, China's manufacturing Purchasing Managers' Index (PMI) has contracted for the sixth month in a row, signaling ongoing challenges in the country's industrial sector. This decline is significant as it reflects broader economic issues, including reduced demand and potential impacts on global supply chains. Investors and policymakers are closely monitoring these trends, as sustained weakness in manufacturing could hinder China's economic recovery and affect international markets.

— Curated by the World Pulse Now AI Editorial System