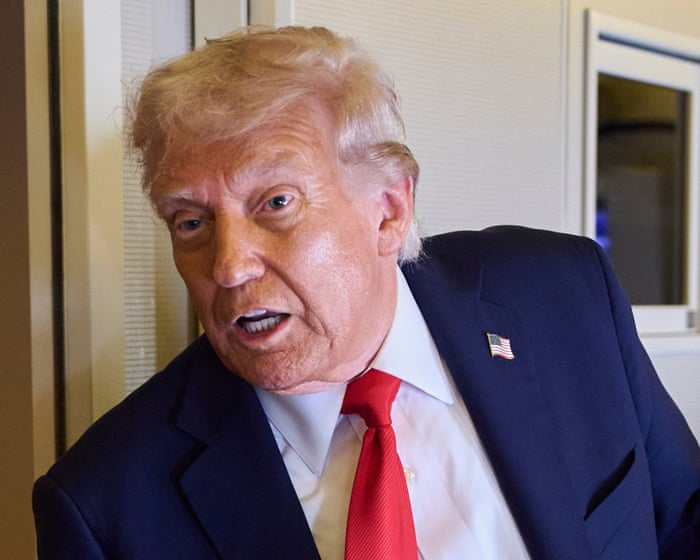

Trump policies threaten US clean energy jobs engine, report says

NegativeFinancial Markets

A recent report highlights how former President Trump's policies could jeopardize the burgeoning clean energy job market in the U.S. This is significant because the clean energy sector has been a vital source of employment and innovation, driving economic growth and addressing climate change. If these policies remain in place, it could hinder progress towards a sustainable future and impact thousands of workers in the industry.

— Curated by the World Pulse Now AI Editorial System