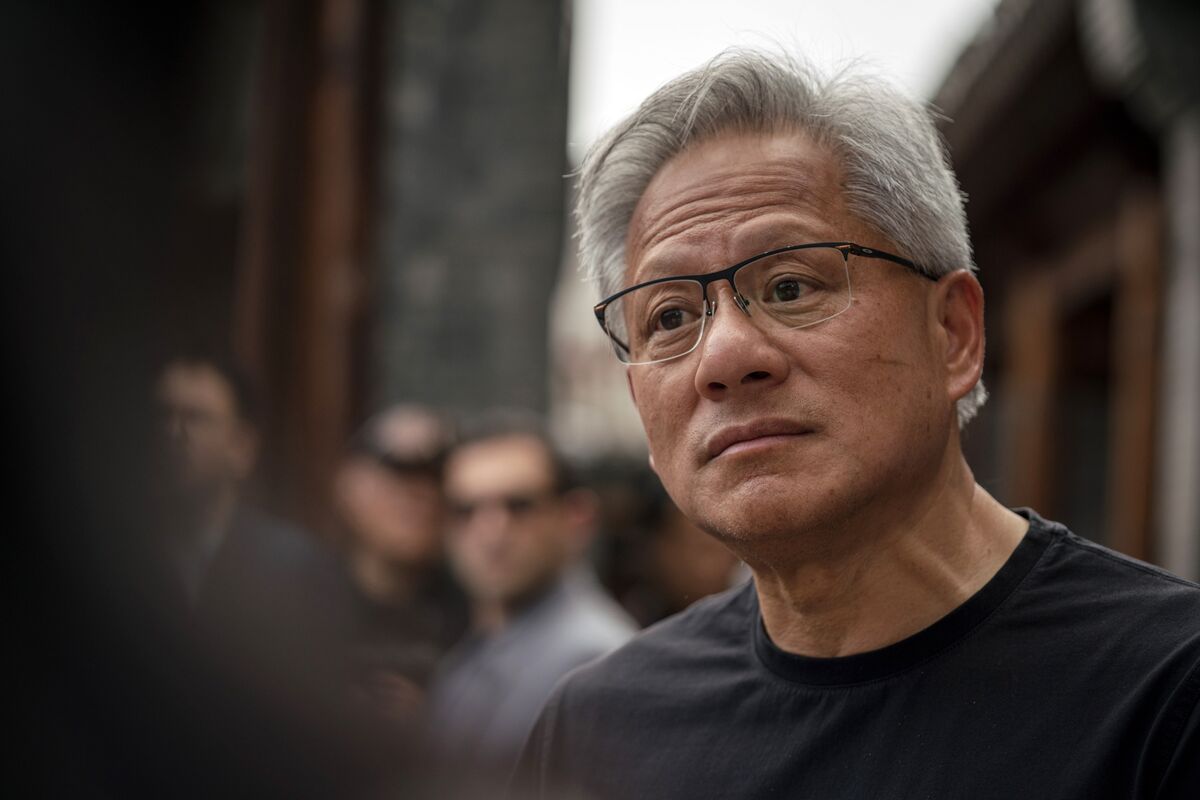

Nvidia/OpenAI Deal: Chipmaker Investing 100 Billion In ChatGPT Maker

PositiveFinancial Markets

Nvidia's recent decision to invest $100 billion in OpenAI, the creator of ChatGPT, marks a significant move in the tech industry. This investment comes as OpenAI gears up for a share selloff, potentially valuing the company at around $500 billion. This partnership not only highlights Nvidia's commitment to advancing AI technology but also underscores the growing importance of AI in various sectors. As these two giants collaborate, we can expect innovative developments that could reshape the future of artificial intelligence.

— Curated by the World Pulse Now AI Editorial System