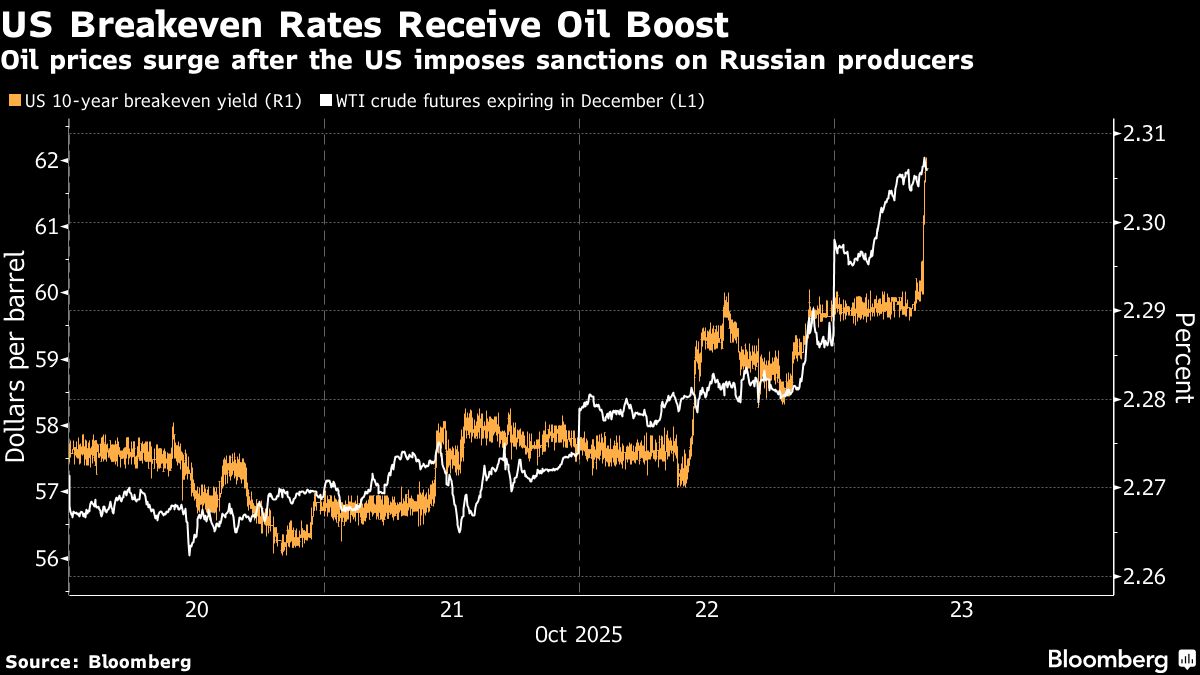

Treasuries Set to Fall, Oil Prices Surge Ahead of Inflation Report

NegativeFinancial Markets

Treasuries are expected to decline after a three-day increase, as rising oil prices raise concerns about inflation ahead of the upcoming US inflation report. This matters because it highlights the potential impact of fluctuating oil prices on the economy and investor sentiment, especially as inflation remains a critical issue for policymakers.

— Curated by the World Pulse Now AI Editorial System