Saudi Arabia Aims to Grow Debt Market to Help Fund Giga Projects

PositiveFinancial Markets

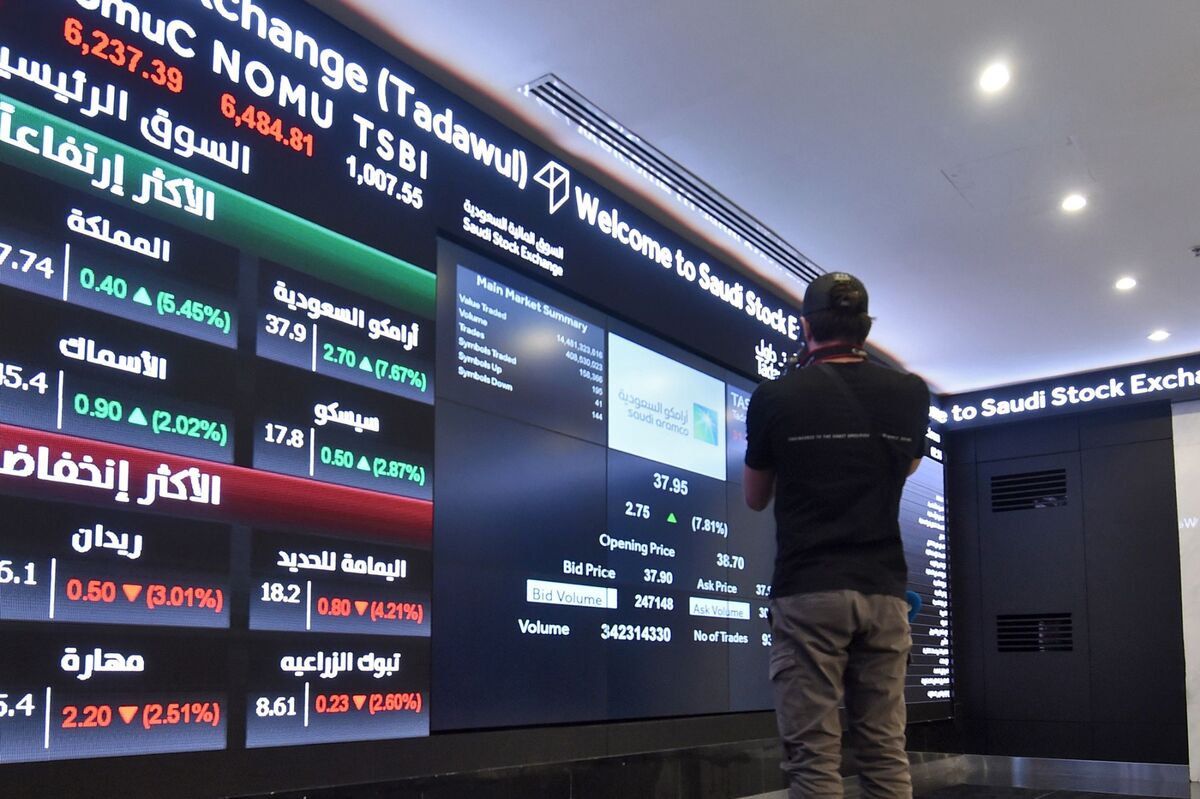

Saudi Arabia is taking significant steps to expand its local debt markets, aiming to secure more capital for its ambitious construction projects. This move is crucial as it reflects the kingdom's commitment to economic growth and development, enabling the funding of large-scale initiatives that could transform the region.

— Curated by the World Pulse Now AI Editorial System