Reliance Global adds bitcoin to treasury in digital asset push

PositiveFinancial Markets

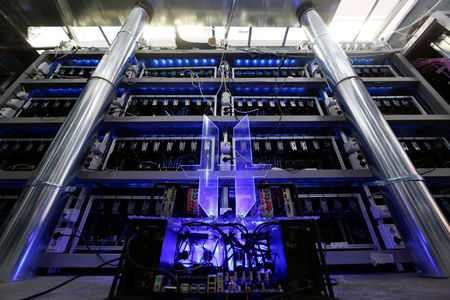

Reliance Global has made a significant move by adding bitcoin to its treasury, marking a bold step in its digital asset strategy. This decision not only reflects the growing acceptance of cryptocurrencies in mainstream finance but also positions Reliance Global as a forward-thinking player in the evolving digital landscape. By embracing bitcoin, the company aims to enhance its financial flexibility and attract a new wave of investors interested in digital assets.

— Curated by the World Pulse Now AI Editorial System