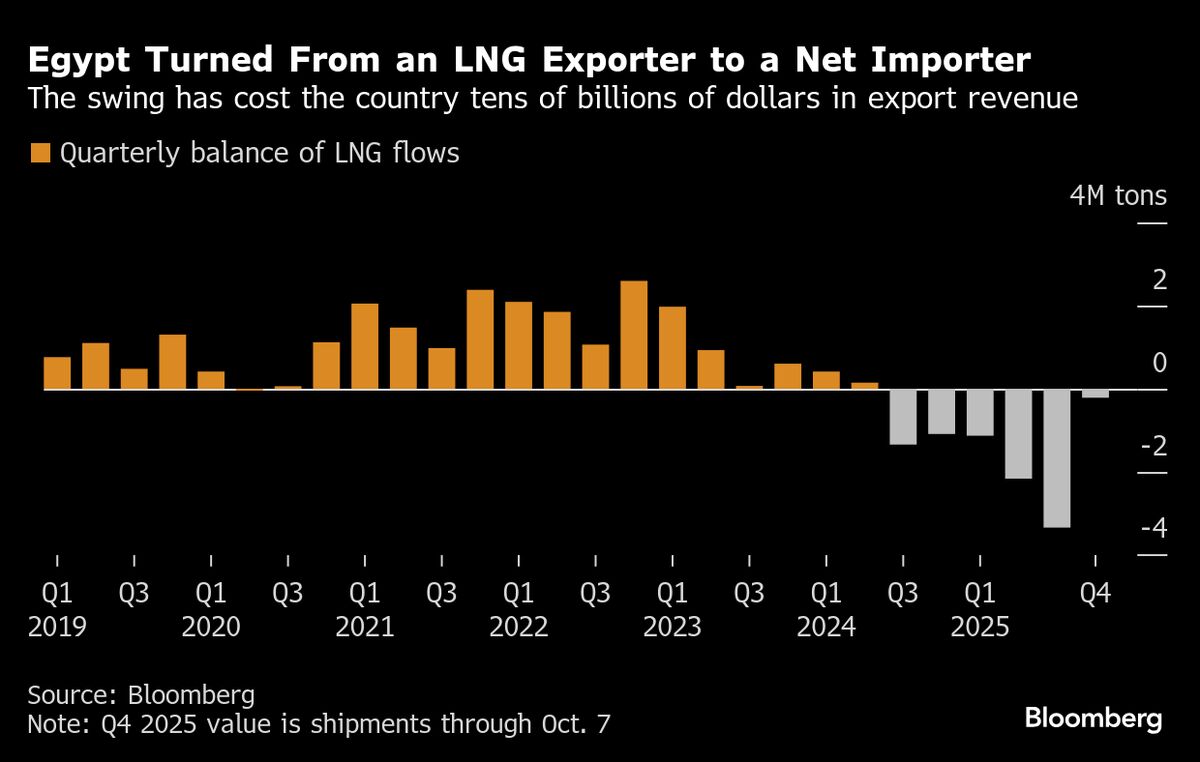

Egypt Asks LNG Suppliers to Delay Shipments Through Year-End

NegativeFinancial Markets

Egypt is requesting its liquefied natural gas suppliers to postpone shipments planned for the remainder of the year due to lower-than-anticipated demand. This situation highlights the challenges facing Egypt's energy sector and could impact its economic stability, as reduced LNG imports may affect both domestic energy supply and international trade relations.

— Curated by the World Pulse Now AI Editorial System