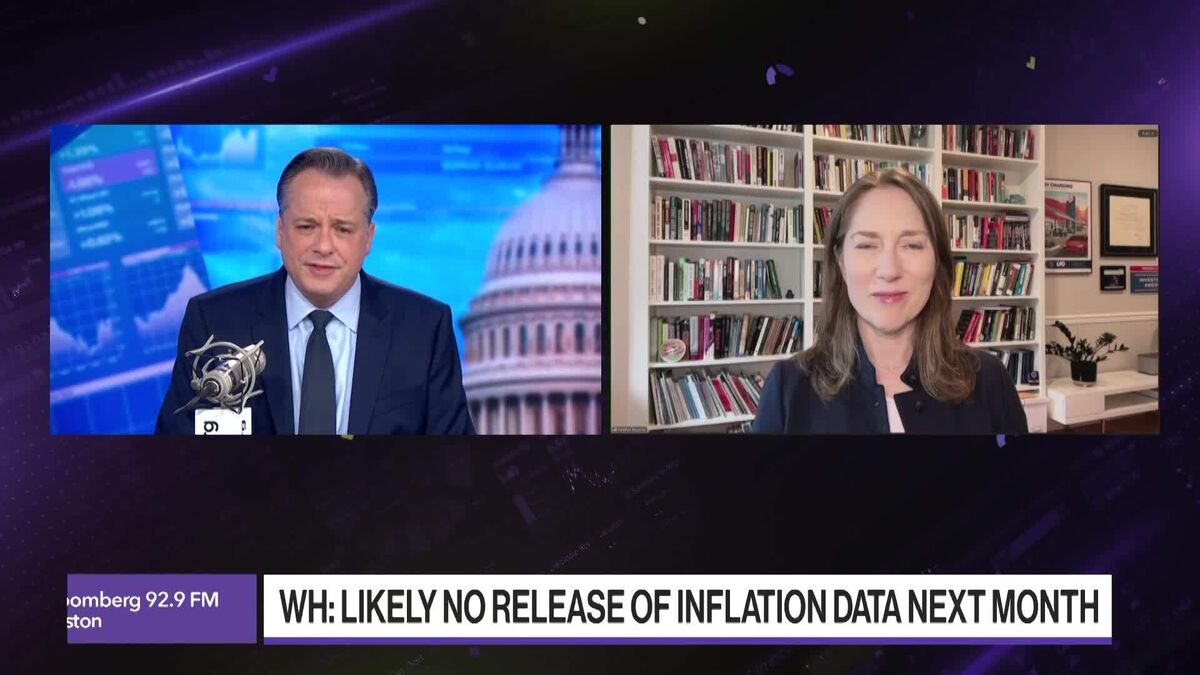

Inflation Bond Market Faces ‘Debt-Limit Equivalent’ in CPI Delay

NegativeFinancial Markets

The US Treasury market, particularly the inflation bond sector, is facing uncertainty as the government announced a likely delay in releasing October's inflation data. This situation is significant because it could impact investor confidence and market stability, especially for those seeking protection against rising consumer prices.

— Curated by the World Pulse Now AI Editorial System