Cooperation Pacts Are Giving Some Creditors a Leg Up

NeutralFinancial Markets

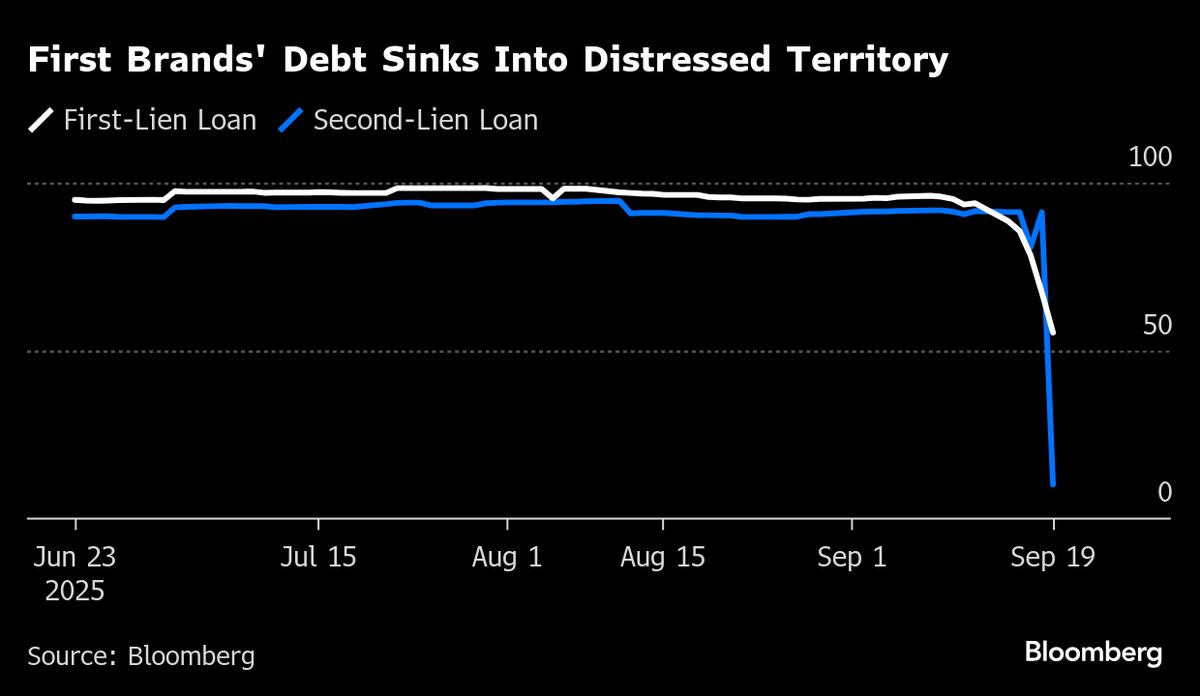

Recent cooperation pacts among creditors aim to ease tensions between lenders, but a specific clause may inadvertently raise the value of certain financial instruments linked to steering committees. This development is significant as it highlights the complexities of financial agreements and their potential impact on market dynamics.

— Curated by the World Pulse Now AI Editorial System