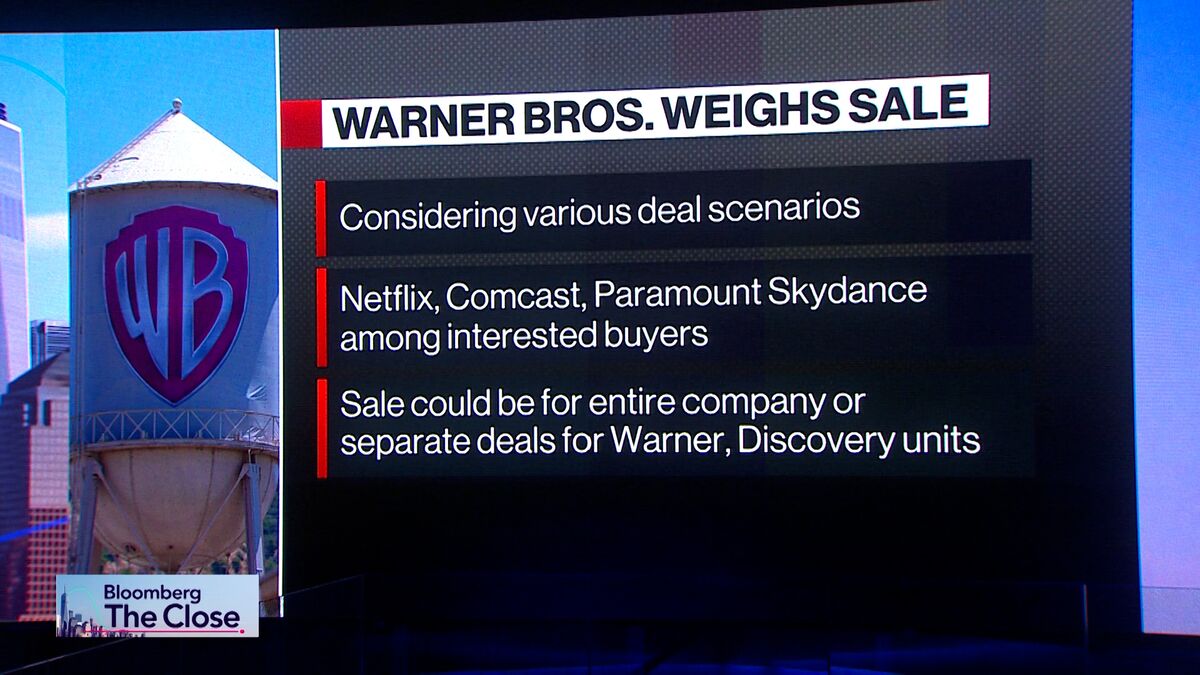

From Time Inc to Discovery: Warner Bros sale plan puts spotlight on checkered M&A history

NeutralFinancial Markets

Warner Bros is planning a sale that highlights its complex history with mergers and acquisitions, particularly its transition from Time Inc to Discovery. This move is significant as it reflects the ongoing evolution in the media landscape and raises questions about the future direction of major entertainment companies. Understanding these shifts is crucial for investors and consumers alike, as they can impact content creation and distribution.

— Curated by the World Pulse Now AI Editorial System