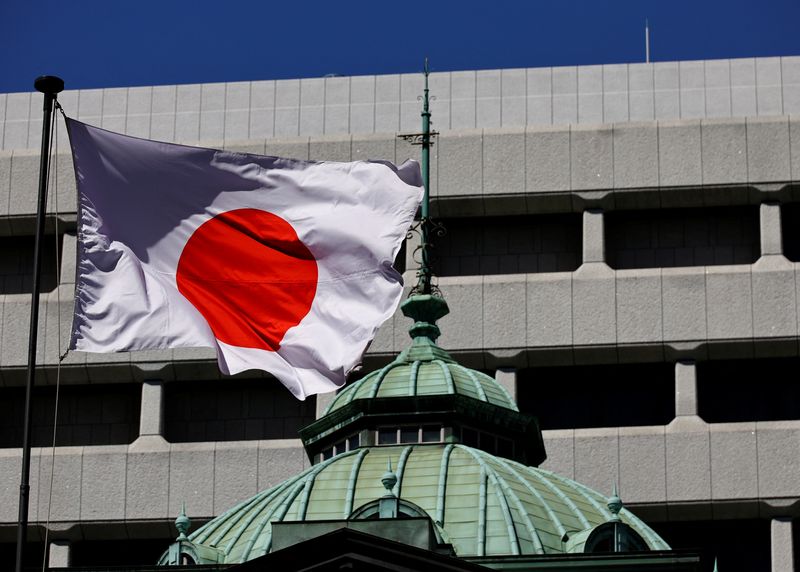

BOJ keeps interest rates steady, decides to start selling ETFs

NeutralFinancial Markets

The Bank of Japan (BOJ) has decided to maintain its current interest rates while also initiating the sale of exchange-traded funds (ETFs). This move is significant as it reflects the BOJ's ongoing strategy to manage economic stability and influence market conditions. By keeping interest rates steady, the BOJ aims to support growth, while the sale of ETFs could signal a shift in its approach to asset management, potentially impacting investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System