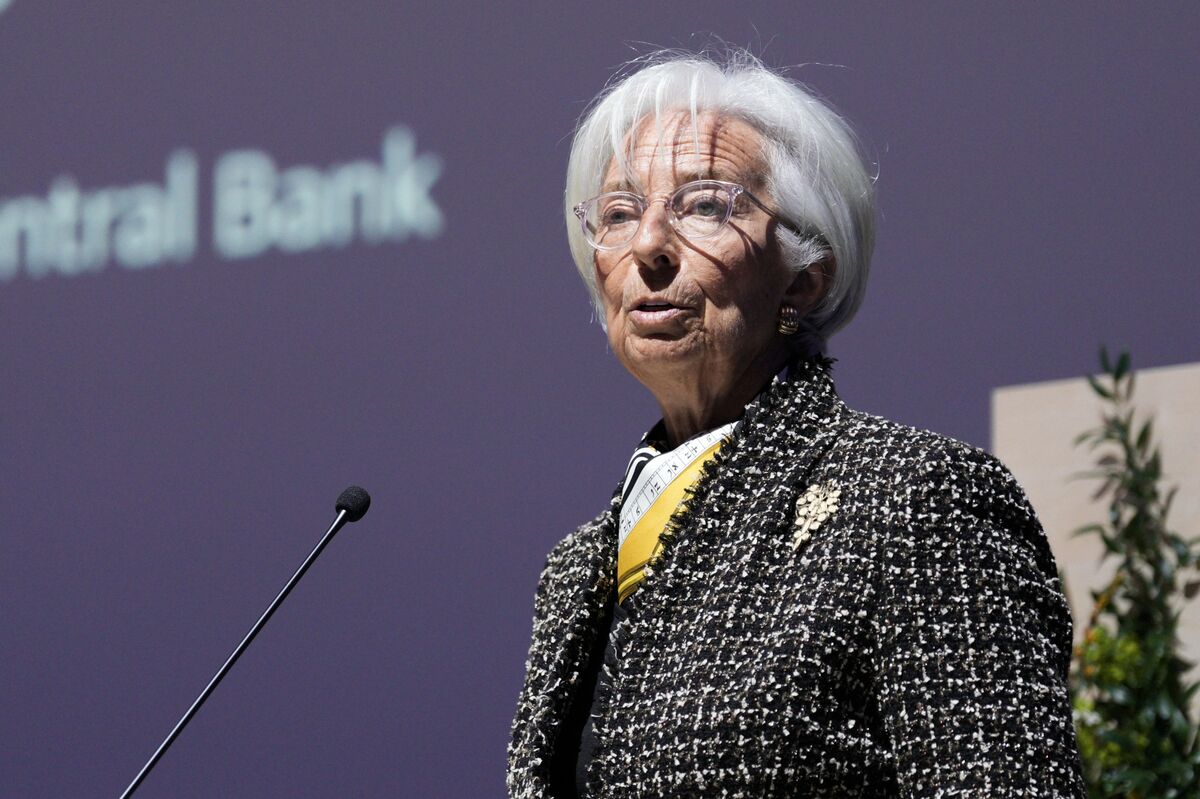

Lagarde Sees ECB on Target With Growth Headwinds Fading Soon

PositiveFinancial Markets

Christine Lagarde, the President of the European Central Bank, has expressed optimism about the bank's progress towards its inflation target, indicating that growth challenges are expected to diminish soon. This is significant as it suggests a potential economic recovery on the horizon for Europe, with forecasts pointing to an uptick in economic activity by 2026.

— Curated by the World Pulse Now AI Editorial System