Treasuries Fall as Traders Weigh Fed ‘Tug of War’ on Rate Views

NeutralFinancial Markets

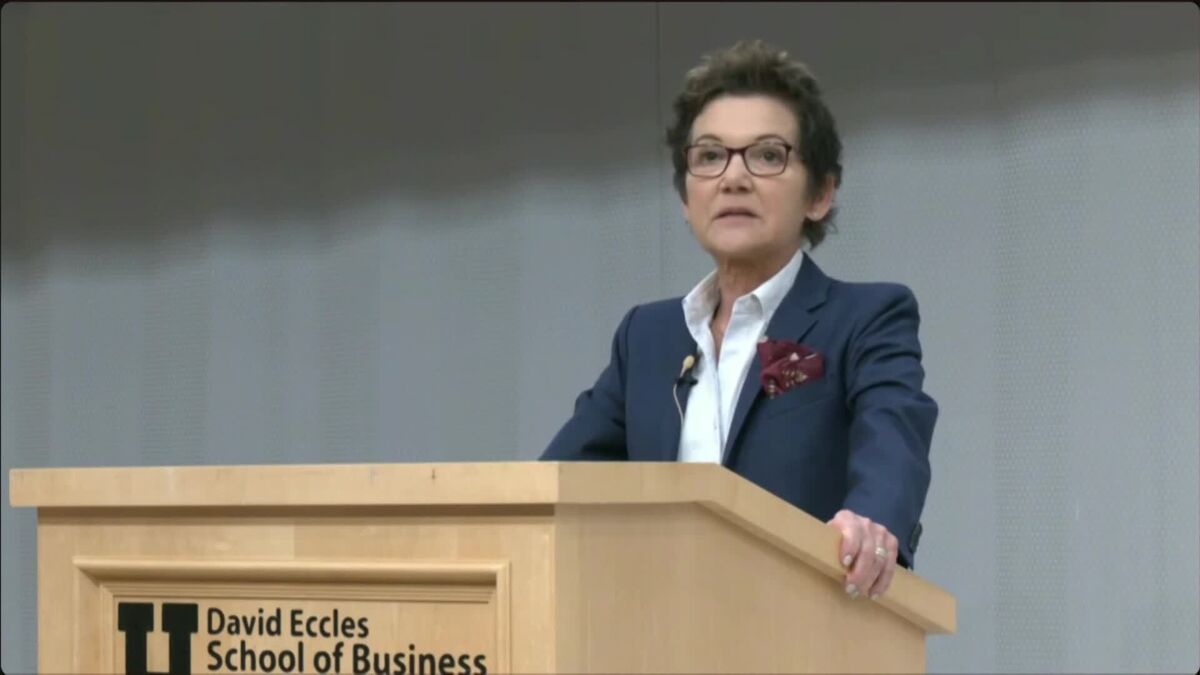

Treasuries have seen a decline as traders navigate conflicting perspectives from Federal Reserve officials regarding future interest-rate cuts. This situation is significant as it reflects the uncertainty in the market and the potential impact on economic policies, which can influence borrowing costs and investment decisions.

— Curated by the World Pulse Now AI Editorial System