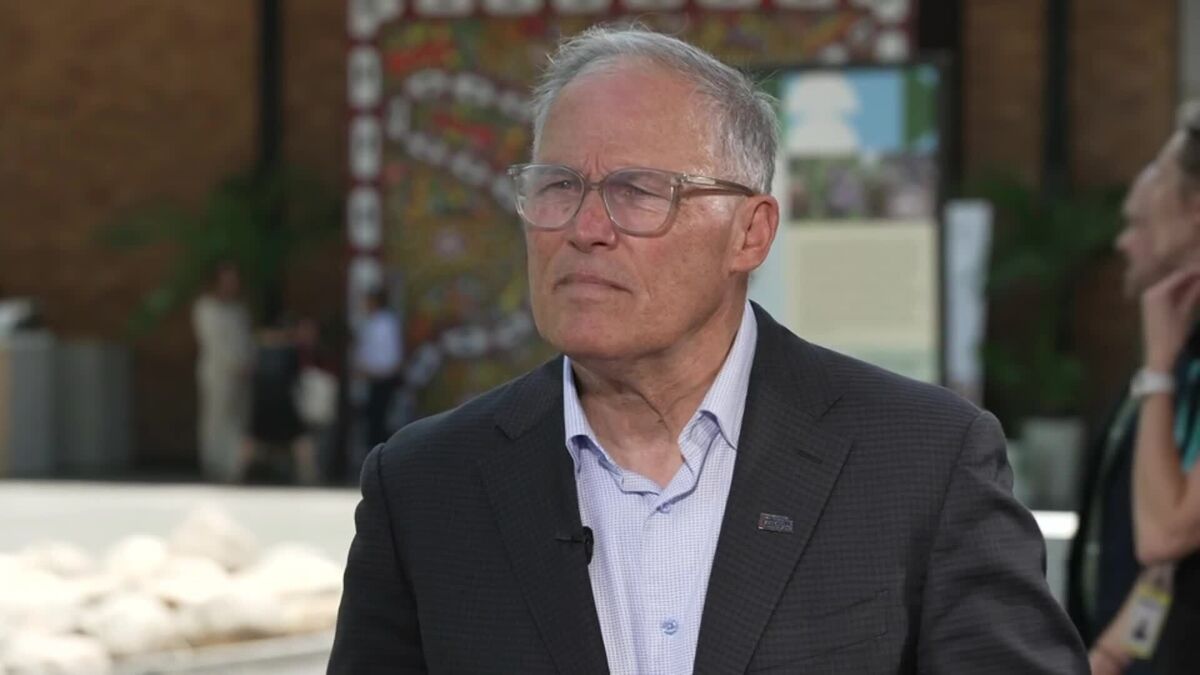

EMCOR at William Blair Fireside Chat: Strategic Growth in Data Centers

PositiveFinancial Markets

EMCOR at William Blair Fireside Chat: Strategic Growth in Data Centers

EMCOR recently participated in a fireside chat hosted by William Blair, discussing their strategic growth plans in the data center sector. This conversation is significant as it highlights EMCOR's commitment to expanding its footprint in a rapidly growing industry, which is crucial for supporting the increasing demand for data storage and processing. Their insights into future trends and investments could provide valuable guidance for stakeholders and investors looking to understand the evolving landscape of data centers.

— via World Pulse Now AI Editorial System