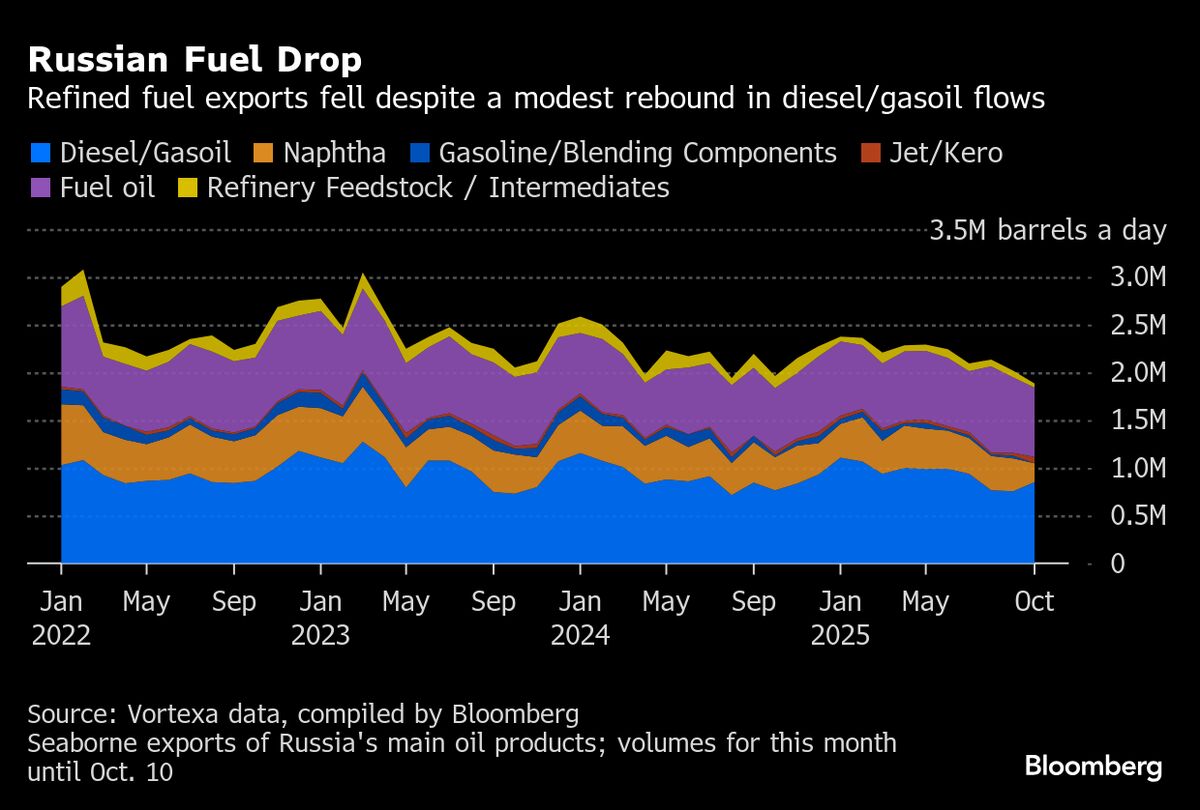

Russian Fuel Exports Sink to Fresh Wartime Low on Refinery Woes

NegativeFinancial Markets

Russian exports of refined fuels have hit a new low since the Ukraine war began, highlighting ongoing challenges for the country's refineries, which have been targeted by drone attacks from Kyiv. This decline in fuel exports not only reflects the impact of the conflict but also raises concerns about Russia's energy stability and its ability to meet domestic and international demands.

— Curated by the World Pulse Now AI Editorial System