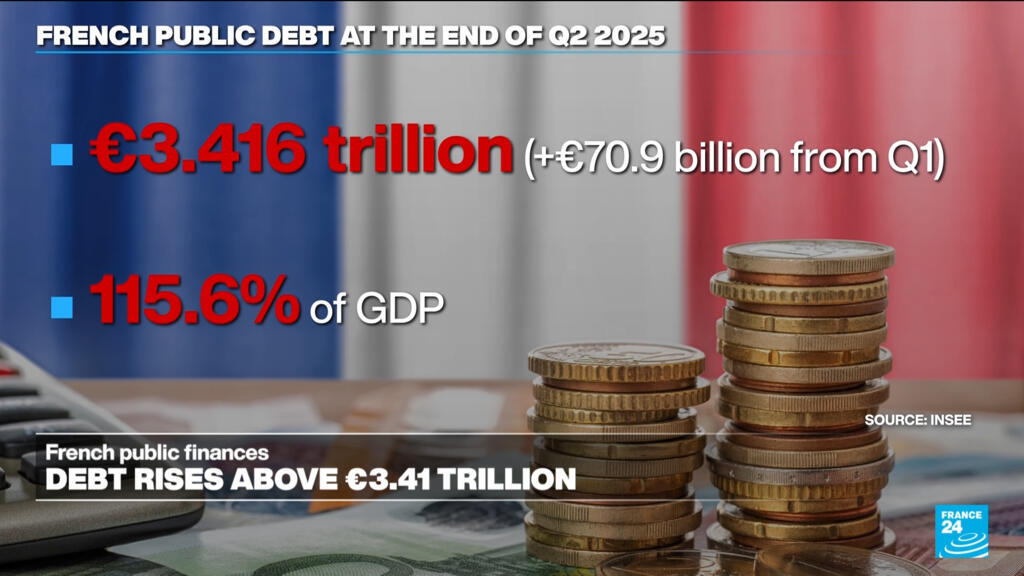

French national debt rises to €3.4 trillion

NegativeFinancial Markets

France's national debt has surged to over €3.4 trillion, reaching 115.6% of its GDP, according to recent data. This alarming rise poses significant challenges for the new Prime Minister, Sebastien Lecornu, who is seeking bipartisan support to draft the 2026 budget due by October 7. The situation is critical as it reflects the country's economic struggles, and the pressure is on to stabilize finances. Additionally, the national rail operator, SNCF, is launching a new ultra-premium class to compete internationally, highlighting the need for innovation amidst financial difficulties.

— Curated by the World Pulse Now AI Editorial System