Goldman Sachs, JPMorgan and BofA drop verdicts on Nvidia earnings

PositiveFinancial Markets

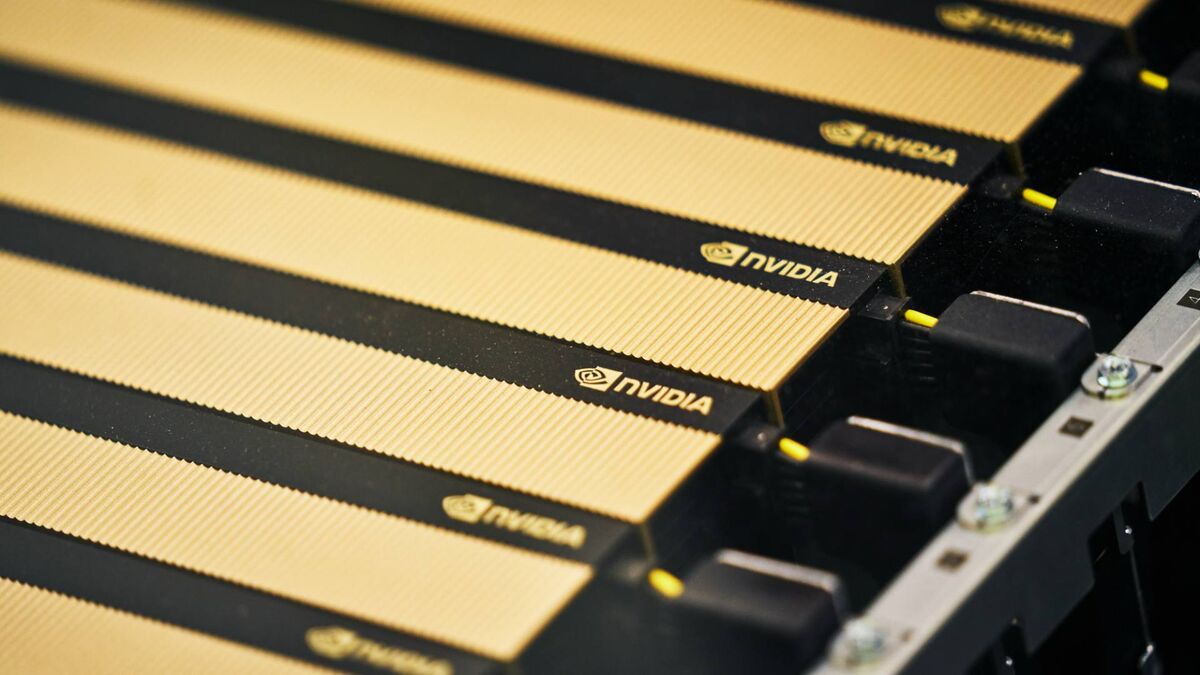

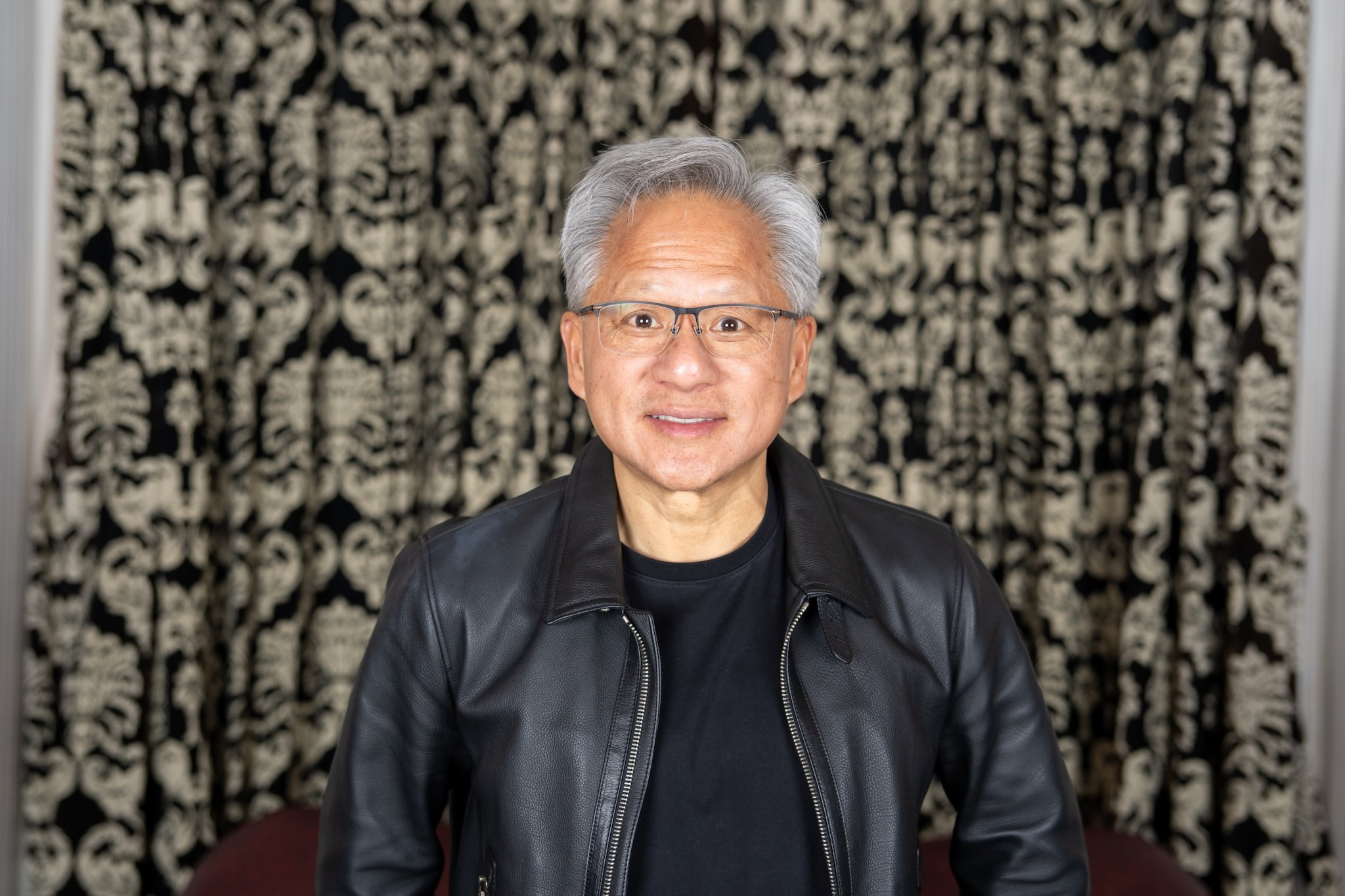

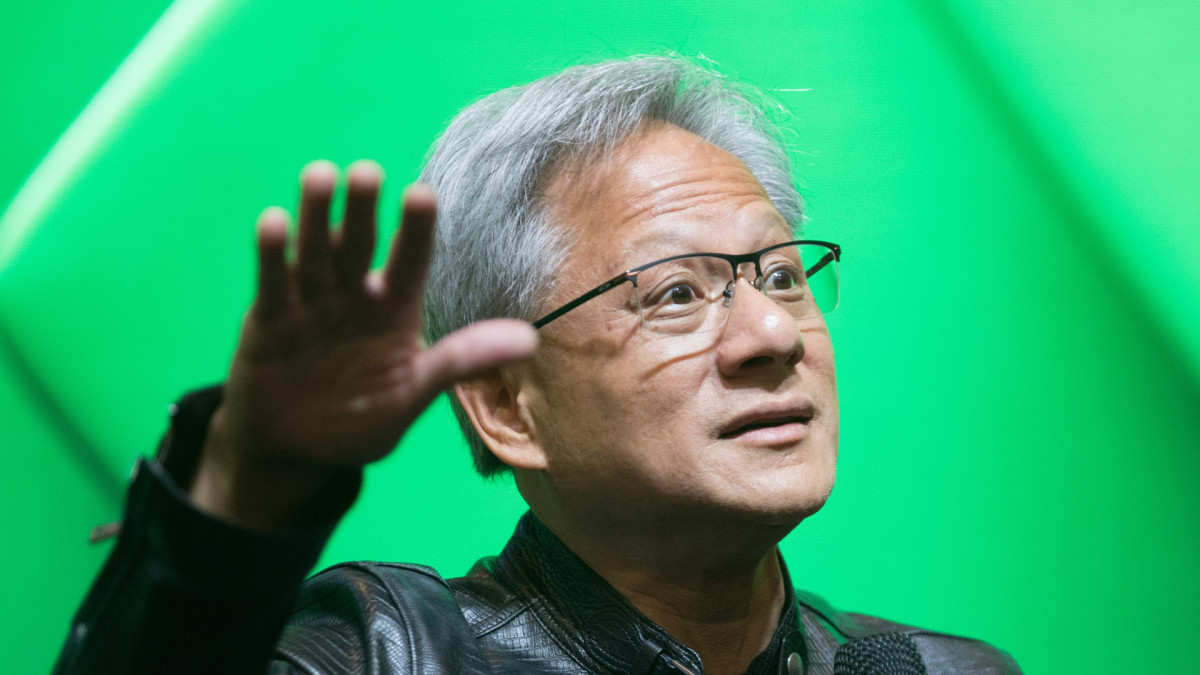

- Nvidia's Q3 earnings report revealed a revenue of $57 billion, significantly surpassing expectations and highlighting the company's strong position in the AI market. CEO Jensen Huang noted the importance of transitioning to Generative AI.

- This strong financial performance is crucial for Nvidia as it reassures investors and stakeholders about the company's growth trajectory amidst rising demand for AI technologies.

- The positive earnings have calmed fears of an AI bubble, contributing to a broader sense of optimism in the tech sector, as Nvidia's success reflects increasing investments and interest in AI infrastructure.

— via World Pulse Now AI Editorial System