Top India Solar Exporter Rejigs Supply Chain to Bypass US Tariff

PositiveFinancial Markets

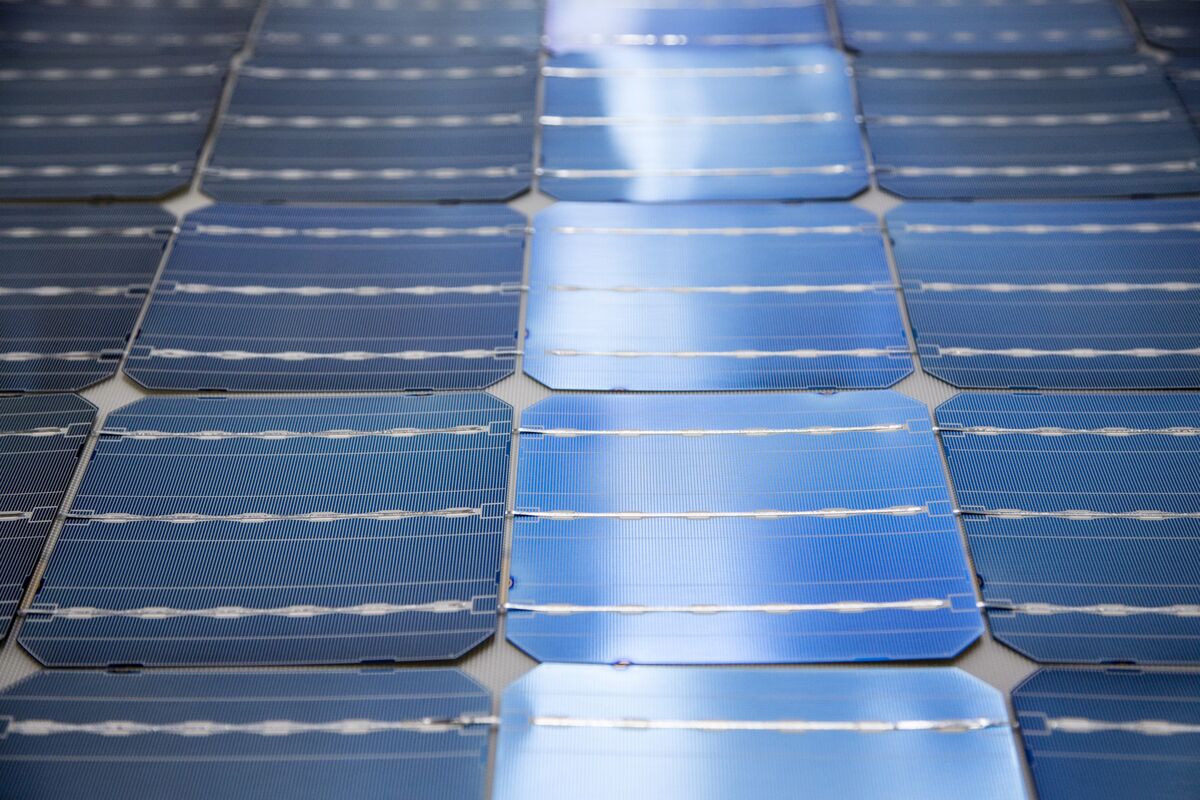

Waaree Energies Ltd., India's leading solar panel manufacturer, is taking proactive steps to adjust its supply chain in response to high US import tariffs. This strategic move is crucial as the US market represents nearly 60% of Waaree's orders, ensuring that the company can continue to meet demand while navigating regulatory challenges. By reconfiguring its operations, Waaree aims to maintain its competitive edge and support the growth of renewable energy in a key market.

— Curated by the World Pulse Now AI Editorial System