French Bond Futures Slip After Snap S&P Downgrade on Budget Risk

NegativeFinancial Markets

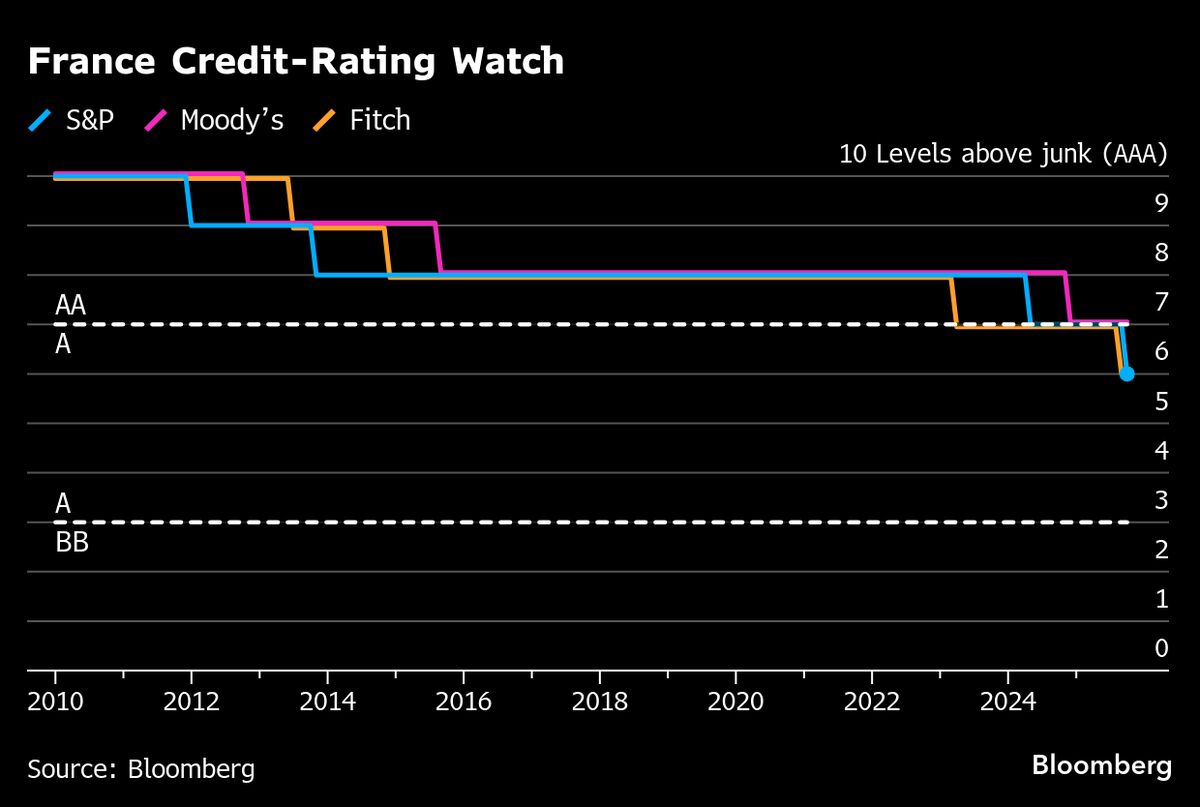

French bond futures have taken a hit following an unexpected downgrade by S&P Global Ratings, which has raised concerns about the country's fiscal stability. This downgrade not only reflects the ongoing budget risks but also puts France's debt at risk of forced selling by certain funds. It's a significant development that could impact investor confidence and the broader financial landscape.

— Curated by the World Pulse Now AI Editorial System