Bullish BofA Options Enticing for Year-End Run, Susquehanna Says

PositiveFinancial Markets

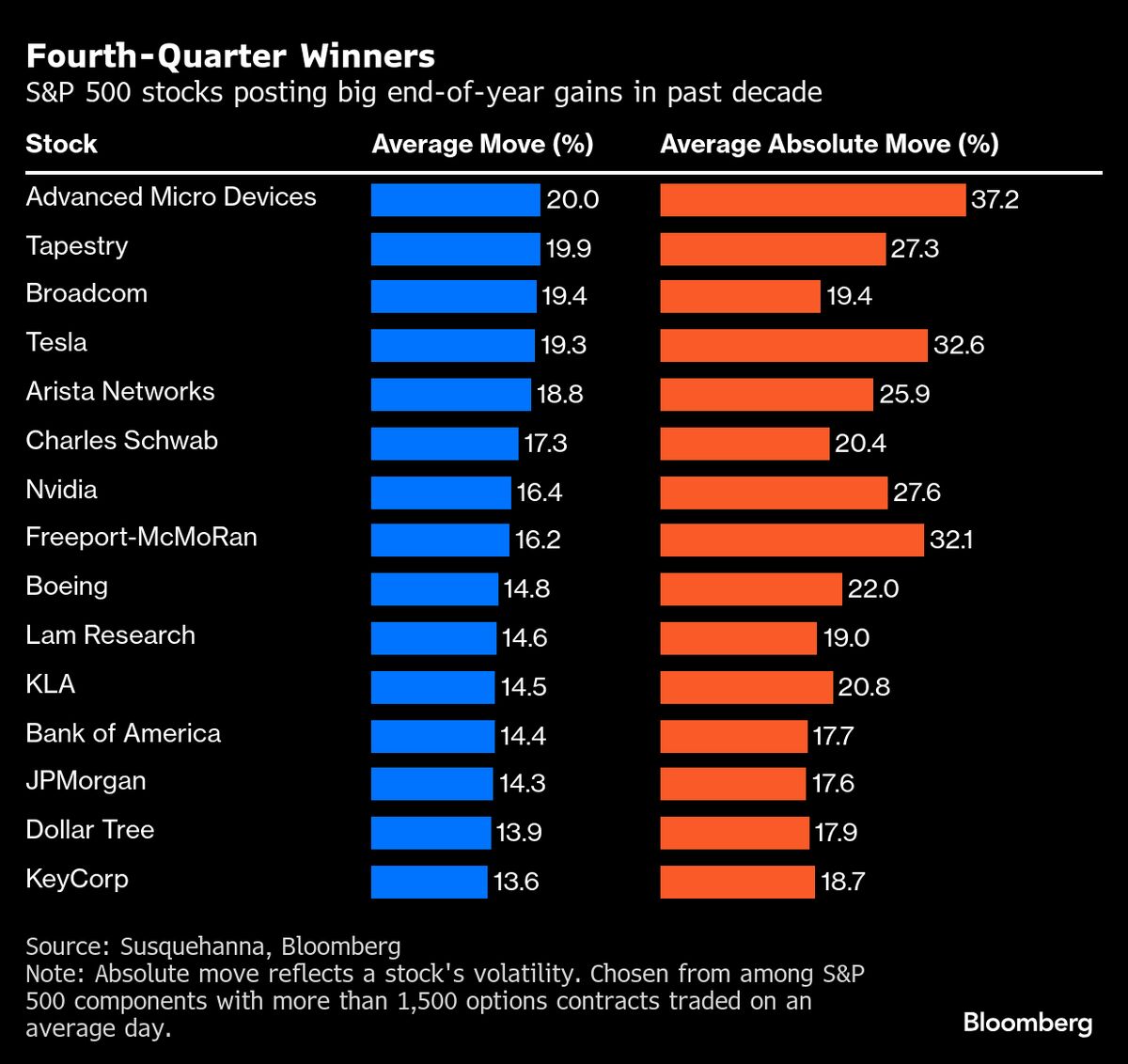

As we approach the end of the year, Susquehanna's Christopher Jacobson highlights the bullish options from Bank of America that could enhance returns for investors. This insight is particularly relevant as the US equity market is on track for another impressive year, making it a prime time for investors to explore strategies that could maximize their gains.

— Curated by the World Pulse Now AI Editorial System