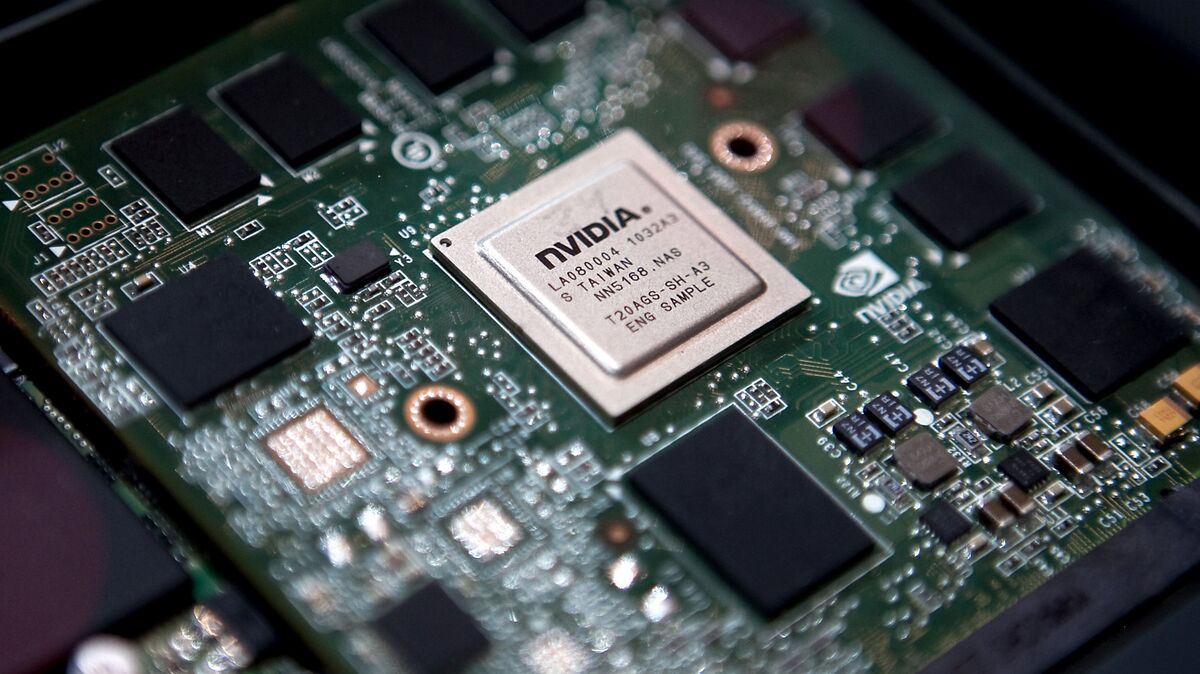

Nvidia's Record $57B AI Earnings Crush Doubts – Why Investors Are Buzzing with Excitement

PositiveFinancial Markets

- Nvidia's record earnings of $57 billion have exceeded Wall Street's expectations, generating a wave of investor excitement and reinforcing confidence in the AI sector's growth.

- This robust financial performance not only alleviates previous concerns regarding the sustainability of the AI boom but also positions Nvidia as a leader in the technology market.

- The positive sentiment surrounding Nvidia's results has invigorated tech stocks broadly, highlighting the interconnectedness of market dynamics and the ongoing debate about the potential for an AI bubble.

— via World Pulse Now AI Editorial System