Dip Buyers Push S&P 500 to Record High as Oracle Shares Slide

PositiveFinancial Markets

- The S&P 500 index reached a record high as dip buyers entered the market following Oracle Corp.'s disappointing earnings report, which raised concerns about the tech sector's ability to capitalize on artificial intelligence investments. Despite Oracle's share decline, the broader market showed resilience, closing at an all-time peak.

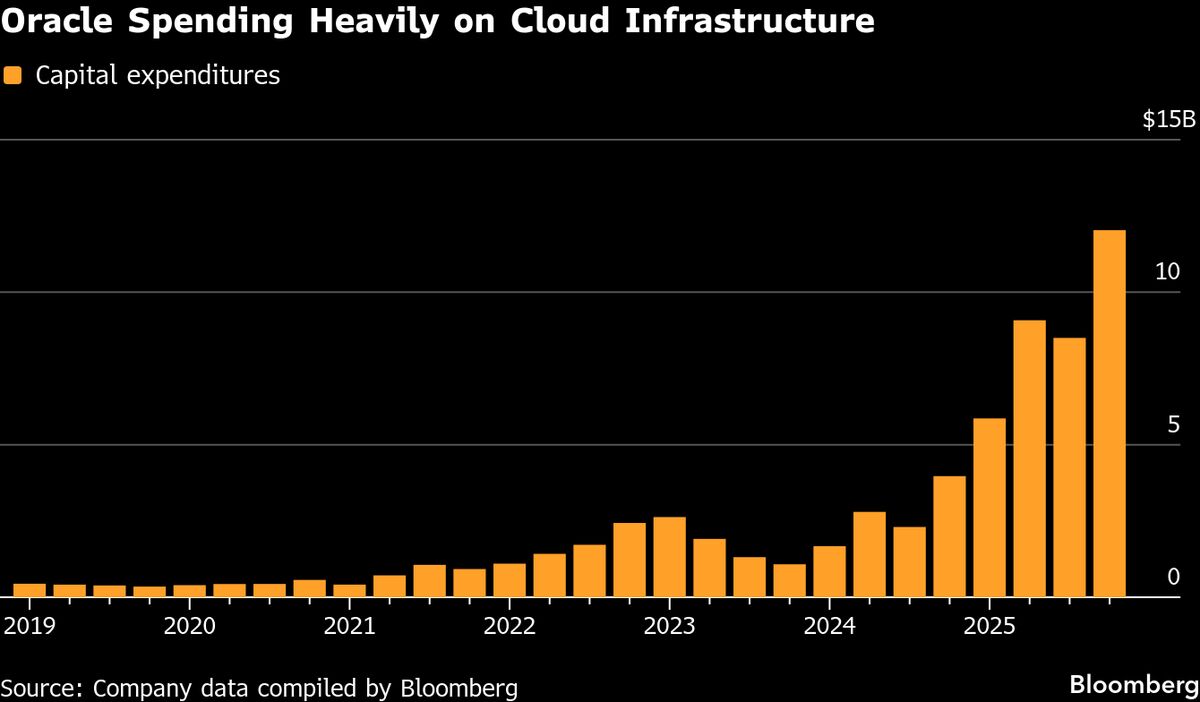

- This development is significant for Oracle as it highlights investor anxiety regarding the company's financial health, particularly after its earnings report indicated increased spending on data centers and a drop in cloud sales, which could impact future profitability.

- The contrasting performance of the S&P 500 amidst Oracle's struggles reflects broader market dynamics, where investor sentiment can diverge significantly between individual companies and the overall market, particularly in the tech sector, which remains sensitive to earnings reports and economic indicators.

— via World Pulse Now AI Editorial System