Federal Reserve expected to cut interest rates amid Trump pressure – live updates

NeutralFinancial Markets

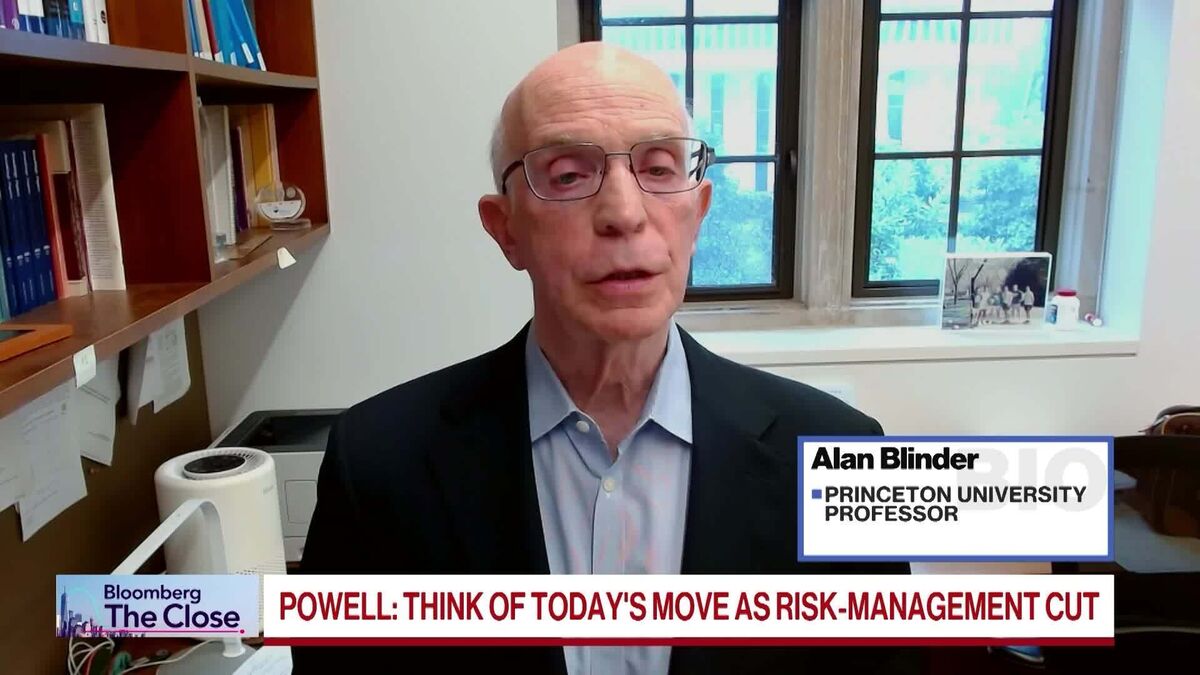

The Federal Reserve is expected to cut interest rates amid ongoing political pressures, particularly from the Trump administration, which has attempted to remove Fed governor Lisa Cook. Despite these efforts, a federal appeals court has ruled that Cook can participate in the upcoming rate-setting meeting. This situation highlights the tension between political influence and the independence of the central bank, making it a significant moment for economic policy and governance.

— Curated by the World Pulse Now AI Editorial System