BoE governor warns ‘alarm bells’ ringing over private credit market

NegativeFinancial Markets

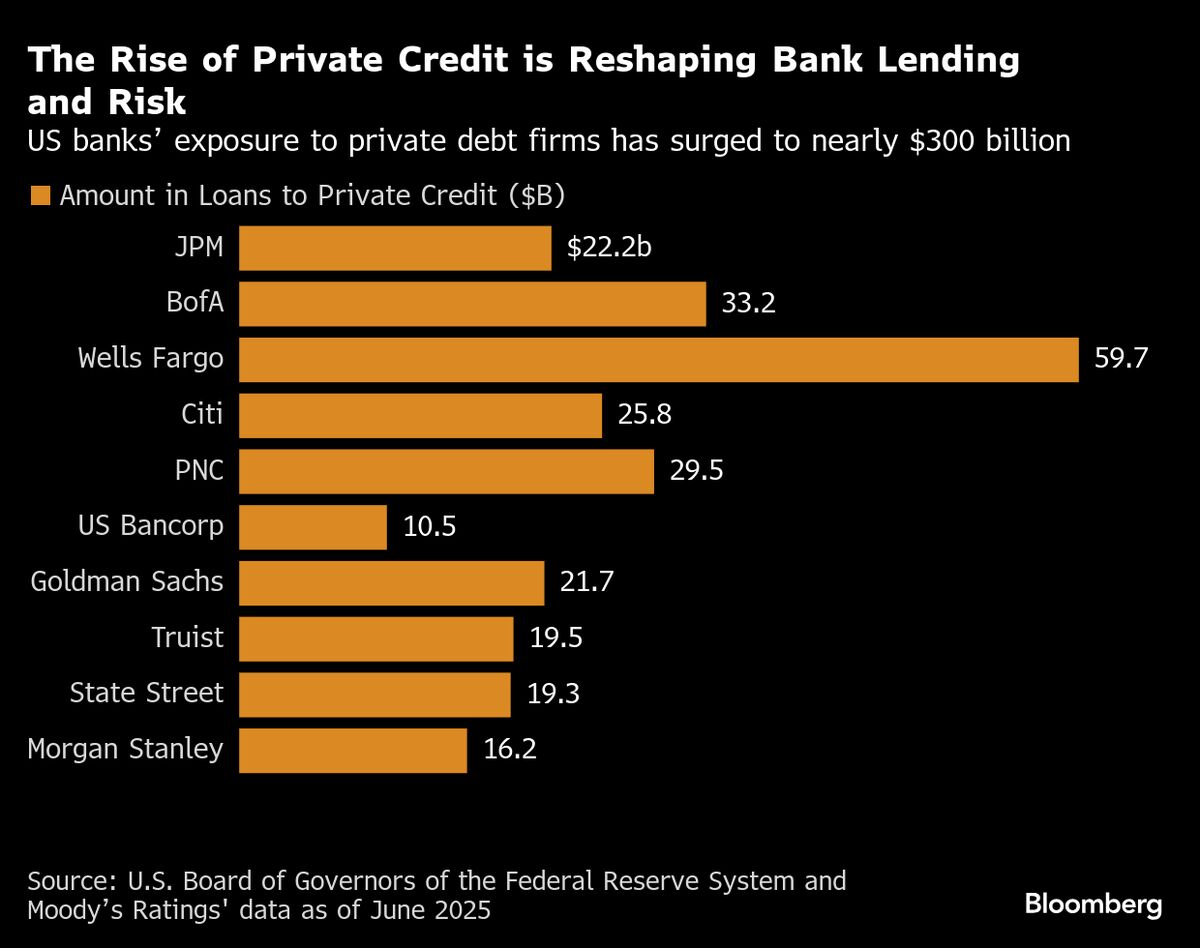

Bank of England Governor Andrew Bailey has raised concerns about the private credit market, likening current practices to those seen before the 2008 financial crisis. His warning serves as a crucial reminder of the potential risks in the financial system, highlighting the need for vigilance and regulation to prevent a repeat of past mistakes.

— Curated by the World Pulse Now AI Editorial System