McGonegal: Markets Not Pricing Enough Uncertainty

NegativeFinancial Markets

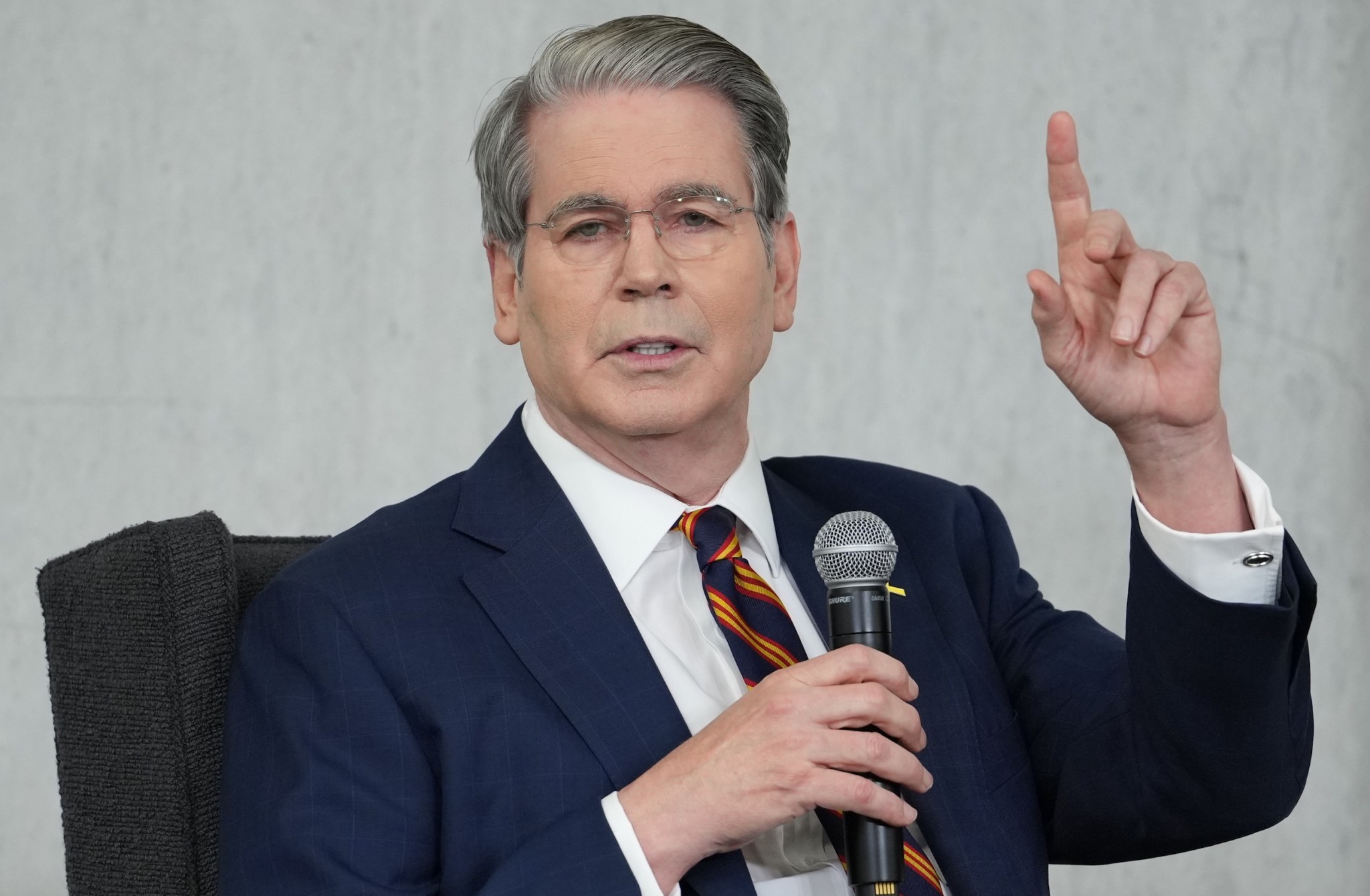

Global stock markets are feeling the heat as new trade tensions between China and the U.S. resurface, raising concerns about economic stability. Brett McGonegal, CEO of Capital Link, highlighted in a recent interview that without genuine cooperation between these two superpowers, we can expect ongoing fluctuations in the markets. This situation is significant as it underscores the fragility of global trade relations and the potential impact on investors and economies worldwide.

— Curated by the World Pulse Now AI Editorial System