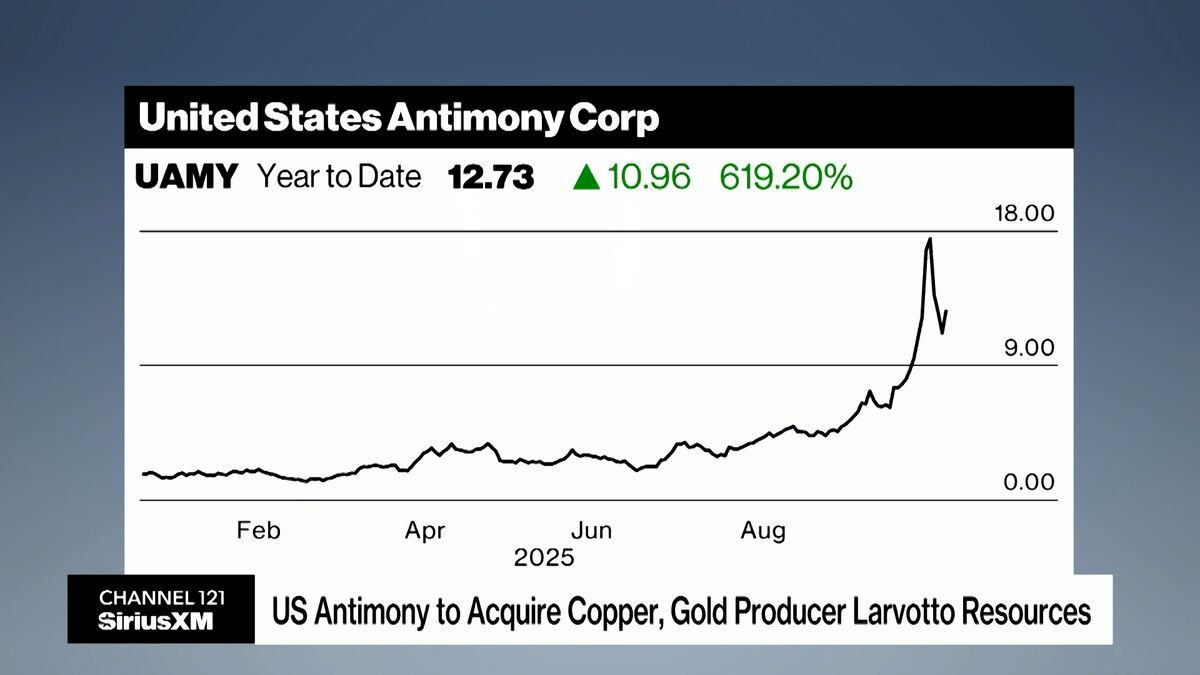

US Antimony to Acquire Larvotto Resources as Trump Signs Australia Mineral Agreement

PositiveFinancial Markets

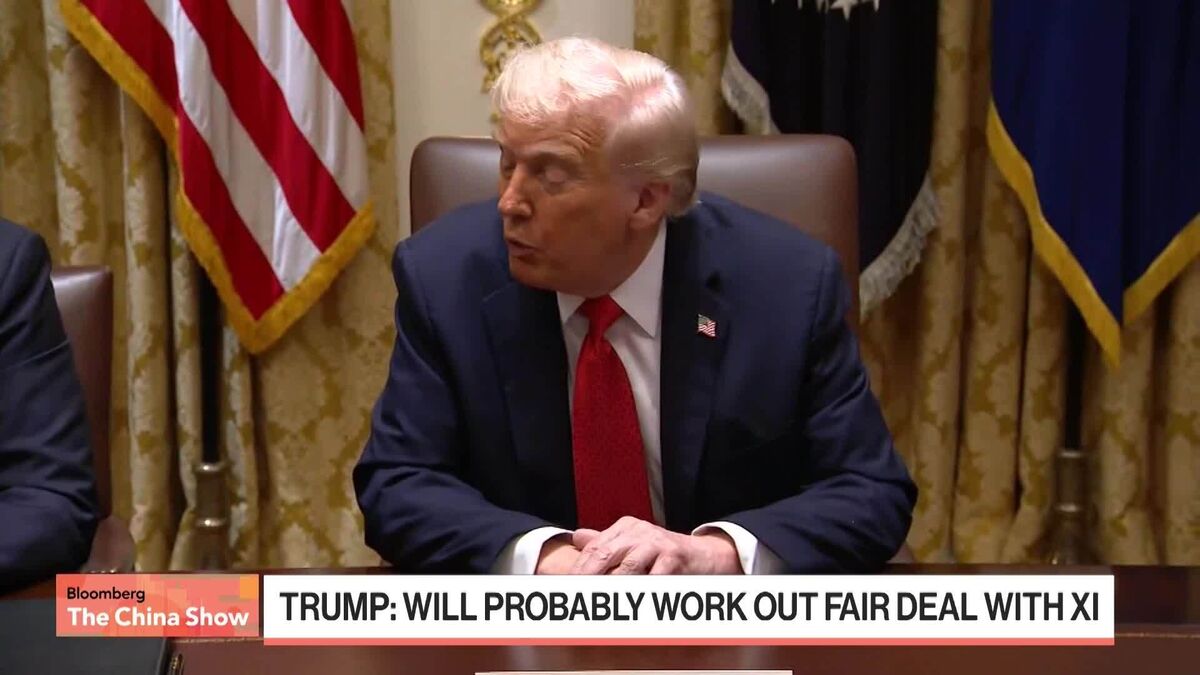

In a significant move for the rare earth industry, President Donald Trump has signed an agreement with Australian Prime Minister Anthony Albanese to enhance access to critical minerals. This development is seen as a positive indicator for companies like US Antimony Corp., which has seen its shares soar over 500% this year. Analyst Neal Dingmann suggests that this could lead to potential government investments in the company, highlighting the growing importance of rare earths in global markets.

— Curated by the World Pulse Now AI Editorial System