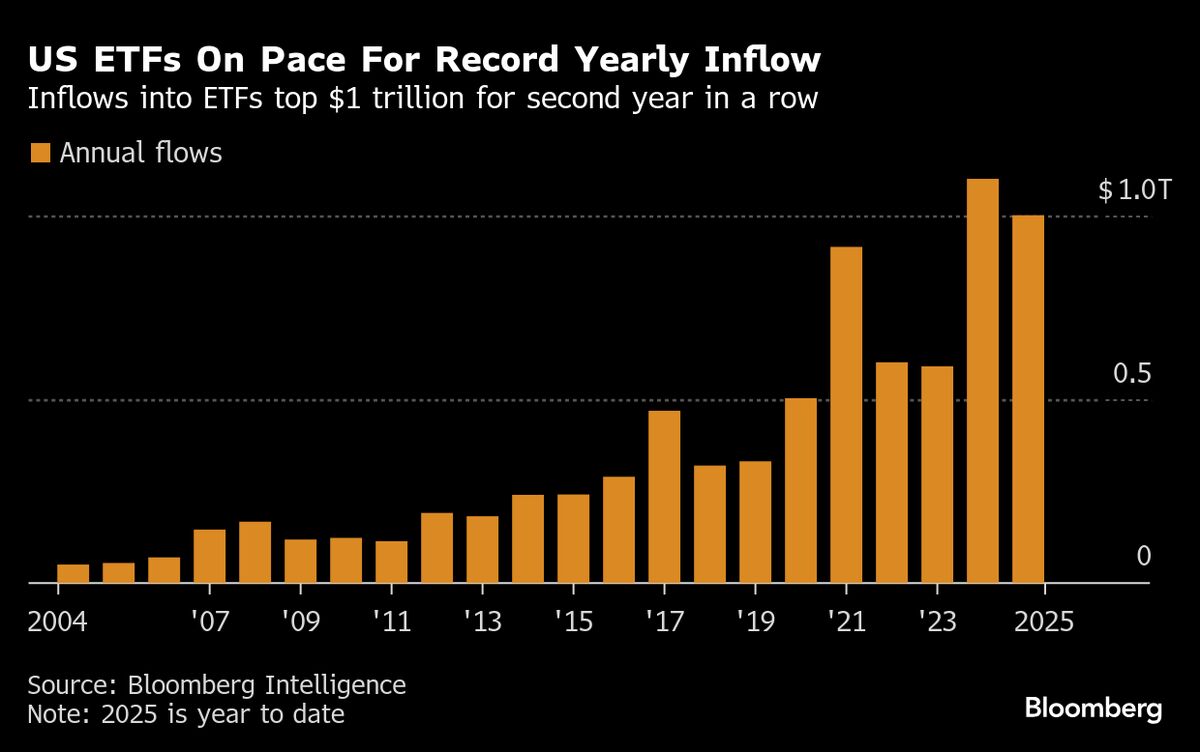

ETF Inflows Smash $1 Trillion Mark in Fastest Run on Record

PositiveFinancial Markets

This year has seen a remarkable surge in ETF buying, with inflows surpassing $1 trillion, marking the fastest growth in the industry's history. This trend reflects investors' confidence in exchange-traded funds as a reliable investment vehicle, especially in response to market fluctuations like the tariff scare in April and the tech pullback in September. Such robust inflows indicate a strong appetite for diversified investment options, which could lead to further innovations and growth in the ETF market.

— Curated by the World Pulse Now AI Editorial System