China and Russia repeatedly tried to defund UN human rights work, report says

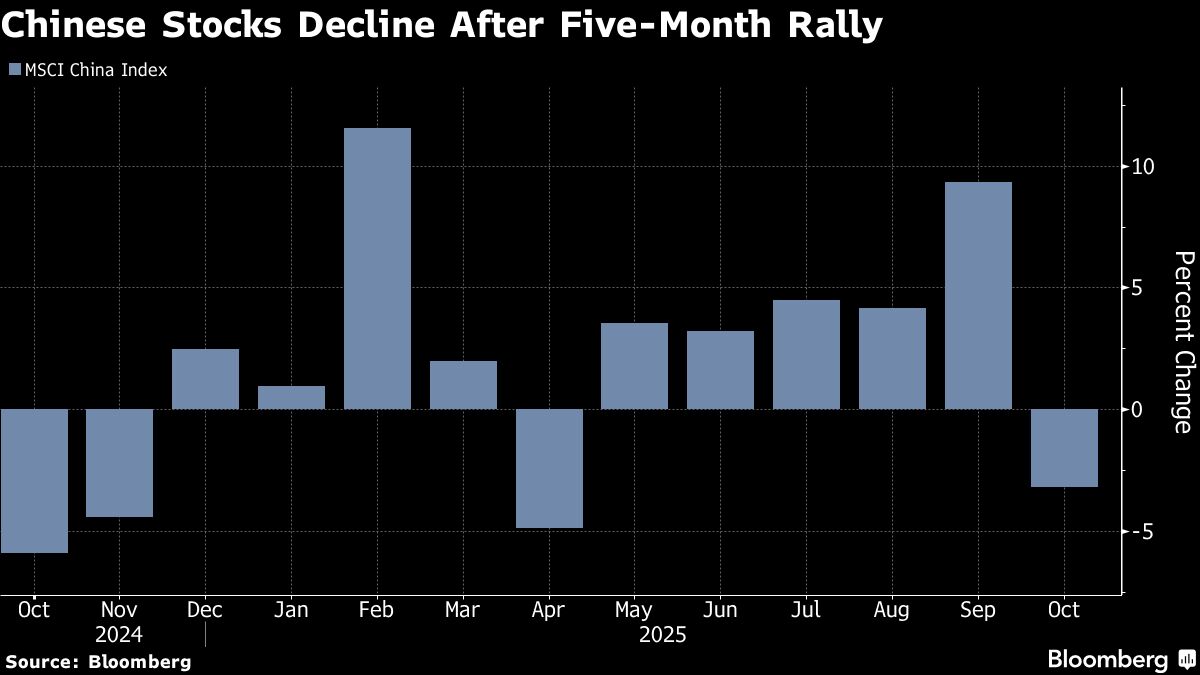

NegativeFinancial Markets

A recent report reveals that China and Russia have made multiple attempts to undermine funding for UN human rights initiatives. This is significant as it highlights the ongoing struggle for human rights advocacy on a global scale, especially in the face of opposition from powerful nations. The implications of these actions could weaken the UN's ability to address human rights violations worldwide.

— Curated by the World Pulse Now AI Editorial System