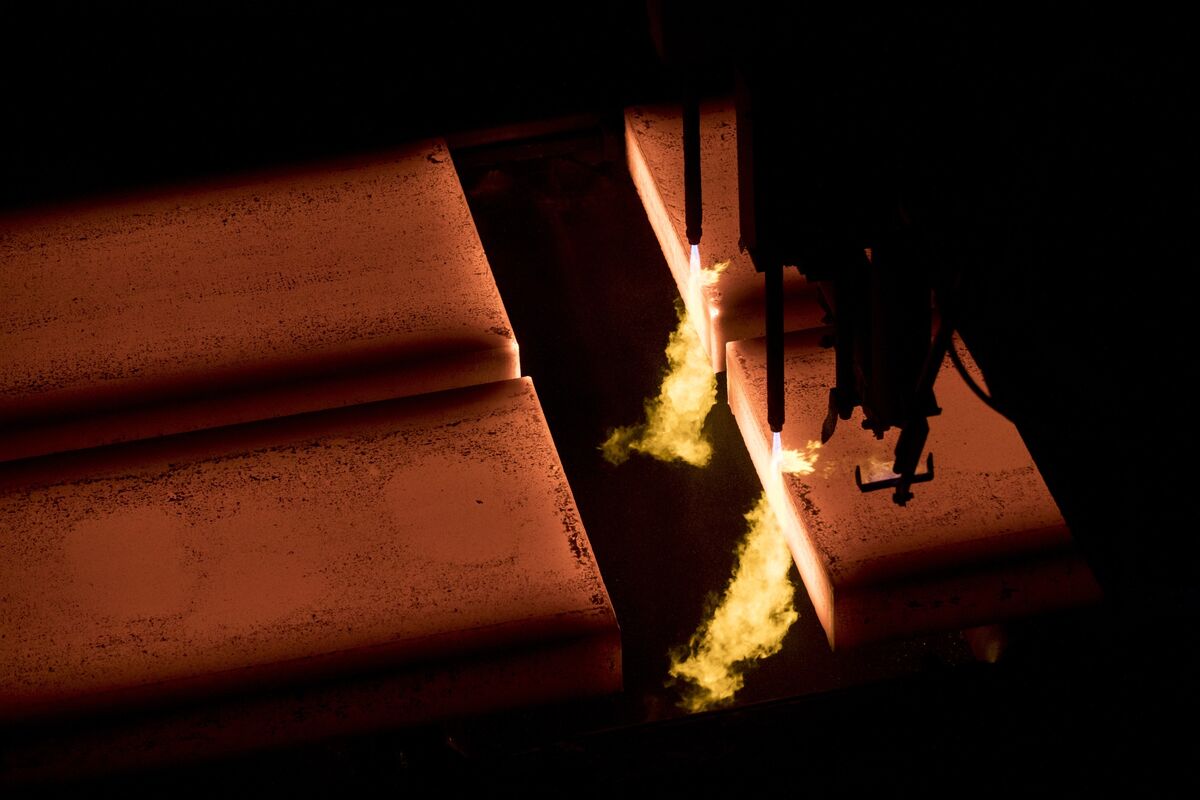

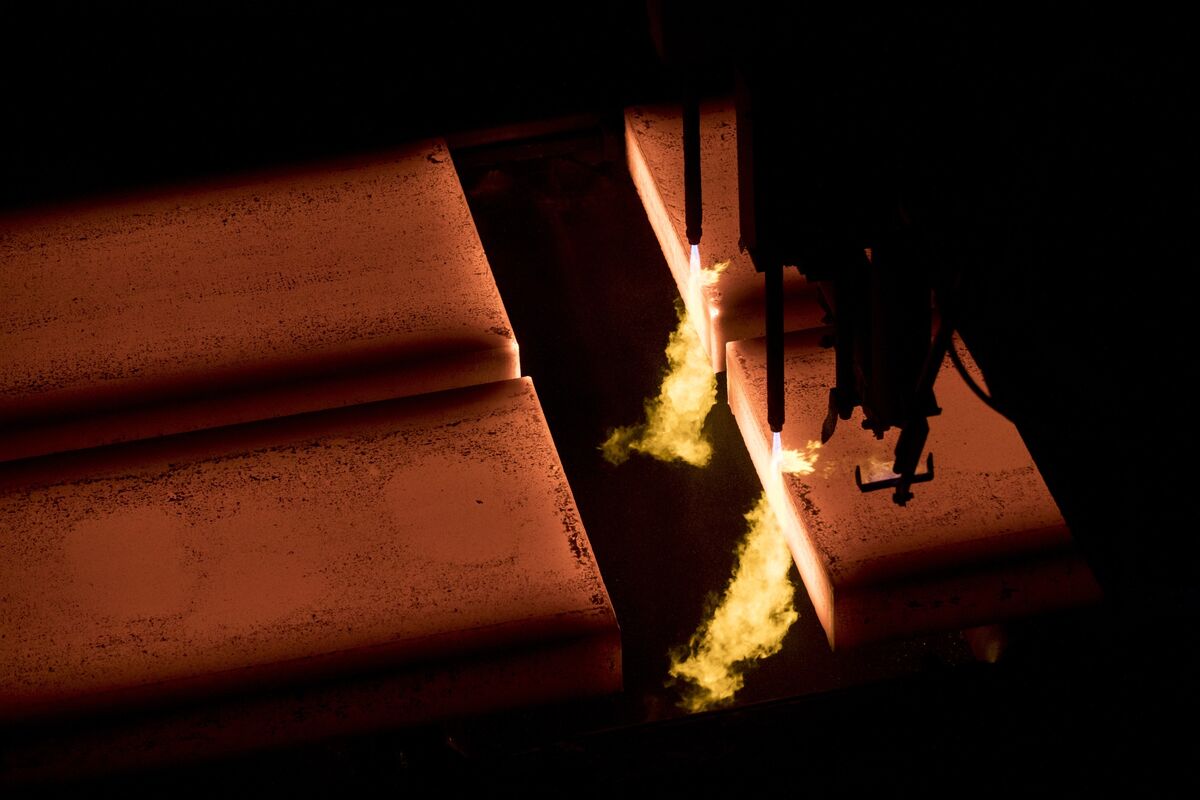

BlueScope Leads Green Steel Push With Bid For Whyalla Steelworks

China faces potential copper output cuts due to ore shortages, while Codelco halts rescue efforts after a tragic mining accident in El Teniente.

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

Switch languages to read your way

Your stories, stored for later

6,119

133

191

21 minutes ago

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

Switch languages to read your way

Your stories, stored for later

6,119

133

191

21 minutes ago

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more