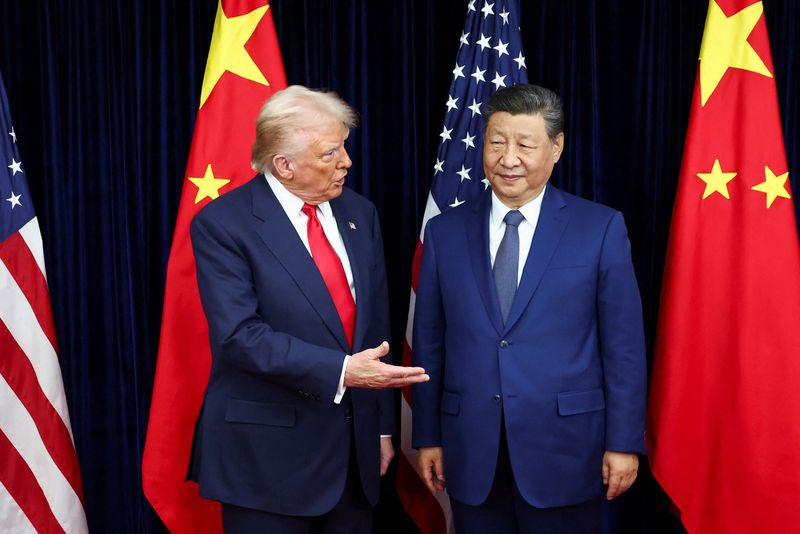

'US Blinked' in Trump, Xi Meeting, Says Mary Lovely of Peterson Institute

NegativeFinancial Markets

Mary Lovely from the Peterson Institute has expressed concerns that the US 'blinked' during trade negotiations with China under the Trump administration. This suggests that the US may have compromised its position, potentially weakening its leverage in future discussions. Such dynamics are crucial as they can impact global trade relations and economic stability.

— Curated by the World Pulse Now AI Editorial System