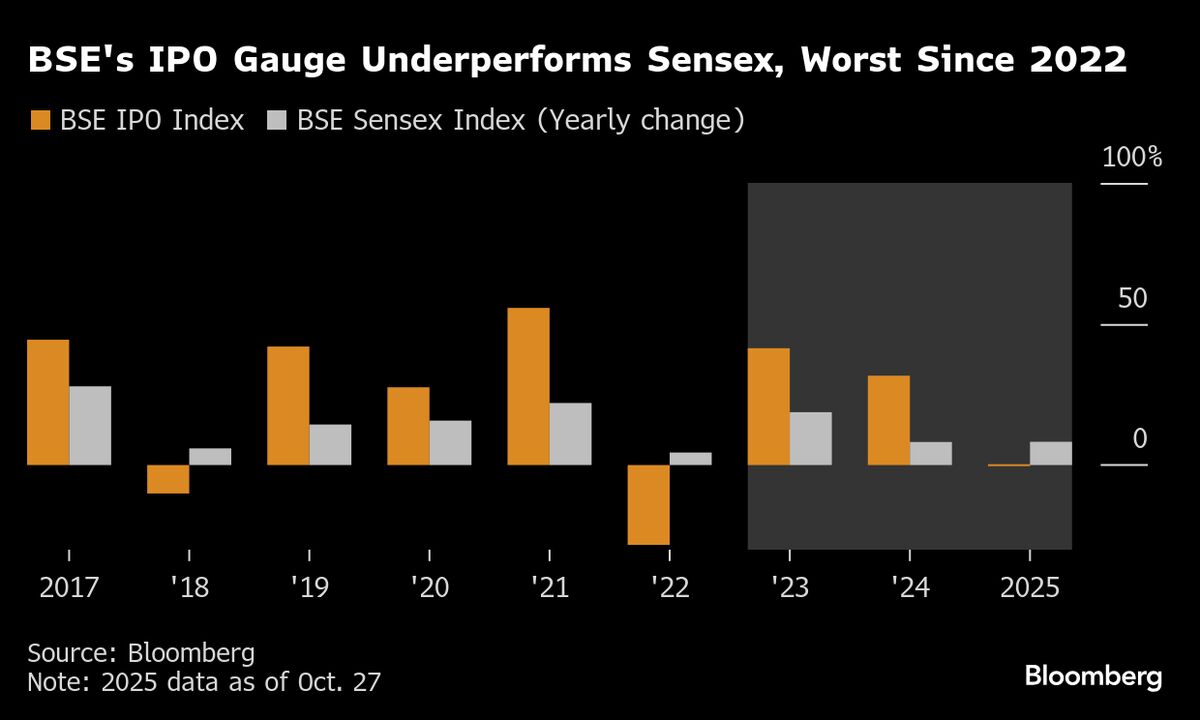

Bumper IPO Gains Shrink in India’s Record-Setting Primary Market

NegativeFinancial Markets

In 2025, the once-booming Indian IPO market is witnessing a decline in outsized gains, as investors are becoming more selective. This shift is significant because it reflects changing market dynamics in one of the world's hottest IPO environments, potentially impacting future fundraising and investment strategies.

— Curated by the World Pulse Now AI Editorial System